webkeds.ru

News

Fastest Way To Invest In Stocks

Opening a brokerage account is typically a quick and painless process that takes only minutes. You can easily fund your brokerage account via an electronic. If i was beginner at stock market then I prefer to you buy IPO(Initial Public Offering) which is low cost in price ie set by company. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. Rebalancing – Prudent Investment Strategy At Market Highs When there is a rally in the stock markets, check if allocation to equity in your portfolio has. It's important to start by setting clear investment goals, determining how much you can invest and how much risk you can tolerate. Then pick a broker that. You need a Vanguard Brokerage Account to trade stocks and ETFs (exchange-traded funds). It's easy to get started, and we can help you along the way. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. What do I know about the stock market? Am I going to lose my money? What's the difference between a stock and a bond anyway? The fact is, if you've been. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Opening a brokerage account is typically a quick and painless process that takes only minutes. You can easily fund your brokerage account via an electronic. If i was beginner at stock market then I prefer to you buy IPO(Initial Public Offering) which is low cost in price ie set by company. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. Rebalancing – Prudent Investment Strategy At Market Highs When there is a rally in the stock markets, check if allocation to equity in your portfolio has. It's important to start by setting clear investment goals, determining how much you can invest and how much risk you can tolerate. Then pick a broker that. You need a Vanguard Brokerage Account to trade stocks and ETFs (exchange-traded funds). It's easy to get started, and we can help you along the way. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. What do I know about the stock market? Am I going to lose my money? What's the difference between a stock and a bond anyway? The fact is, if you've been. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker.

For anyone starting out, the fastest way to invest in the stock market is to open up a low cost brokerage account with your personal bank or. “Long term goals, like retirement, require an aggressive allocation, meaning a minimum of 90% in stocks,” says Todd, who explains that the stock market has. As a rule, the easiest first step is to register with an online broker. You could use the services of a financial advisor within that firm, or you could invest. An easy and flexible way to invest · Compare ways to invest. Find an investment $0 per trade is applicable to commissions for online and automated telephone. The best way to invest in the stock market is to buy a low cost, total market index fund and basically hold onto it forever (or until you need it). How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Stocks by the Slice SM makes dollar-based investing easy. Own a slice of your favorite companies and exchange-traded funds (ETFs) for as little as $ Get. Different ways to invest in stocks include self-managed investing, using a financial advisor, or utilizing robo-advisors. • The amount you invest in stocks. buy additional shares of stock, your money has the potential to grow faster. What is the best way to invest when you have thousands of stocks to choose from? quickly place trades directly from key pages in your trading workflow. Discover the basics of stocks and how they might fit into your investment strategy. If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments, even small ones. Where to Start Investing in Stocks The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. SLIDE iNTO. THE STOCK. MARKET · Investing** is simple, whether you're new to it or already have a portfolio · Tiptoe or dive right in · Cash App doesn't take a cut. The stocks of successful turnarounds can move back up quickly Lynch also suggests investing in several categories of stocks as a way of spreading the downside. Through the investment strategy known as “dollar cost averaging,” you can protect yourself from the risk of investing all of your money at the wrong time by. How do you choose how much you want to invest in stocks or bonds? Opening a Vanguard investing account is free, easy—and fast! (It should only. This might sound like basic housekeeping, but the lure of quick gains in the stock market can prevent many people from seeing how dire their overall financial. How to Make Money in Stocks Canada. By Andrew Goldman. 10 min read. What's easier than making a fortune in the stock market? Losing one. A few easy-to-. SLIDE iNTO. THE STOCK. MARKET · Investing** is simple, whether you're new to it or already have a portfolio · Tiptoe or dive right in · Cash App doesn't take a cut. Successful investing requires diversification. This means, for example, investing in multiple stocks in different industries instead of just one or two stocks.

Cheapest Insurance In Maryland

I haven't comparison shopped in a few years, but Progressive was the cheapest for me. I pay ~$/month for two vehicles in Baltimore City. Find Cheap Car Insurance in Maryland with Direct Auto! Looking for affordable car insurance in Maryland? Get a free car insurance quote for a policy that meets. According to Bankrate's analysis, the cheapest car insurance companies in Maryland include USAA, Geico and Nationwide. Good car insurance coverage for most drivers in Maryland is //, which is $, per person, $, per accident in bodily injury liability, and. Find out how you can get the cheapest MAIF insurance rates with Roadway Auto. Call for a free My MD Auto Insurance quote. This will be the state-required minimum liability car insurance, plus UIM, that averages $ per month, much higher than the national average of $47 and the. Geico and Travelers have the overall cheapest car insurance in Maryland for good drivers, based on the companies in our analysis. The Cheapest Car Insurance. Find cheap car insurance in Maryland with our comprehensive guide for cheap insurance at webkeds.ru The average cost of full coverage car insurance fin Maryland is $1, per year. That is actually cheaper than the national average cost of car insurance, which. I haven't comparison shopped in a few years, but Progressive was the cheapest for me. I pay ~$/month for two vehicles in Baltimore City. Find Cheap Car Insurance in Maryland with Direct Auto! Looking for affordable car insurance in Maryland? Get a free car insurance quote for a policy that meets. According to Bankrate's analysis, the cheapest car insurance companies in Maryland include USAA, Geico and Nationwide. Good car insurance coverage for most drivers in Maryland is //, which is $, per person, $, per accident in bodily injury liability, and. Find out how you can get the cheapest MAIF insurance rates with Roadway Auto. Call for a free My MD Auto Insurance quote. This will be the state-required minimum liability car insurance, plus UIM, that averages $ per month, much higher than the national average of $47 and the. Geico and Travelers have the overall cheapest car insurance in Maryland for good drivers, based on the companies in our analysis. The Cheapest Car Insurance. Find cheap car insurance in Maryland with our comprehensive guide for cheap insurance at webkeds.ru The average cost of full coverage car insurance fin Maryland is $1, per year. That is actually cheaper than the national average cost of car insurance, which.

A typical car insurance policy in Maryland includes coverage for bodily injury and property damage liability, as well as optional collision and comprehensive. Who Has the Cheapest Car Insurance in Maryland? Our partner Travelers has the cheapest auto insurance in Maryland, with the average full coverage policy costing. USAA has the best and cheapest car insurance in Maryland, with minimum rates starting at $43/mo. Find more cheap Maryland auto insurance companies here. Find and compare the best auto insurance rates in Maryland from car insurance providers in your area. Find the cheapest auto insurance rates and get a quote. Geico has the best cheap liability car insurance in Maryland. Quotes from Geico average $67 per month, or $ per year, 27% lower than the state average. Maryland Insurance Administration. Section Menu. Consumers. Consumers Home Compare the insurers and rates provided for that scenario in that zip code. The most affordable bundled home and auto insurance rates in Maryland are from State Farm. In addition, Travelers provides the lowest auto rates following the. Car insurance quotes in Maryland start at $/mo. Compare the cheapest car insurance quotes in Maryland from USAA, GEICO, Safeco, and more. Finding affordable home insurance means comparing prices, understanding what coverage you need, and looking for ways to save—including through bundled auto and. In Maryland, the average car insurance rate is $ per year and $ per month which is almost 13% lower than the rate of the national average. Get your auto insurance in Maryland. Good drivers in MD who switch to Root could save up to $/year on their car insurance. Get a free quote. Maryland Insurance Administration. Interactive Auto Insurance Rate Guide Compare the insurers and rates provided for that scenario in that ZIP code. Car insurance quotes in Maryland start at $/mo. Compare the cheapest car insurance quotes in Maryland from USAA, GEICO, Safeco, and more. Elephant Insurance came in with the lowest rate currently available in Maryland at $ per month. Followed by at per month and at per month. Rank, Company. The cheapest type of insurance is the state minimum liability insurance. But even though this is all you're legally required to carry, it's almost always a good. To help you find the cheapest car insurance in Maryland WalletHub collected quotes from all major auto insurers in Maryland. Finding the best car insurance in Maryland means taking the time to compare equal coverages, limits, deductibles, and discounts. Maryland drivers can access. We found that State Farm offers the cheapest annual rate at $1, in Maryland. The most expensive annual auto insurance rates are for Allstate which is $2, Monthly car insurance in Maryland averages about $ for full coverage and roughly $76 for minimum coverage. · Maryland drivers with a speeding ticket pay. The cheapest car insurance companies in Maryland are Travelers, Erie, and Geico because they tend to offer premiums that are cheaper than the state av.

What Is The Difference Between 401k And 457

Perhaps the biggest difference is who can sponsor each plan. Private employers can only offer the (k), while the is an uncommon retirement plan offered. A (f) nonqualified deferred compensation arrangement is a written agreement between the employer and each eligible highly compensated executive to pay. plans offer generous catch-up contributions for workers who are approaching retirement age. Both retirement accounts offer the same tax advantages. Because (b) plans are not governed by ERISA, employees miss out on some benefits (k) participants have. For instance, it protects employees in the event a. plans are commonly offered to government workers, while private-sector companies offer (k)s. plans offer generous catch-up contributions for. In this guide, we'll delve into the differences between these plans, providing a framework on how to approach these plans & hopefully empowering you. The South Carolina Deferred Compensation Program. (Program) provides participants with a supplemental retirement savings strategy through its (k) and. Unlike a (k), withdrawals from a account are not subject to an early withdrawal penalty; however, you will still owe income tax on any withdrawals. Participation. Eligibility. All full-time state and participating university system employees and other government employees eligible for membership in the. Perhaps the biggest difference is who can sponsor each plan. Private employers can only offer the (k), while the is an uncommon retirement plan offered. A (f) nonqualified deferred compensation arrangement is a written agreement between the employer and each eligible highly compensated executive to pay. plans offer generous catch-up contributions for workers who are approaching retirement age. Both retirement accounts offer the same tax advantages. Because (b) plans are not governed by ERISA, employees miss out on some benefits (k) participants have. For instance, it protects employees in the event a. plans are commonly offered to government workers, while private-sector companies offer (k)s. plans offer generous catch-up contributions for. In this guide, we'll delve into the differences between these plans, providing a framework on how to approach these plans & hopefully empowering you. The South Carolina Deferred Compensation Program. (Program) provides participants with a supplemental retirement savings strategy through its (k) and. Unlike a (k), withdrawals from a account are not subject to an early withdrawal penalty; however, you will still owe income tax on any withdrawals. Participation. Eligibility. All full-time state and participating university system employees and other government employees eligible for membership in the.

Carefully selected investment choices to meet your goals. multi-generational family with dog, sitting outside, laughing in the autumn. RetireReadyTN offers a. As we prepare for NRSM in October, we invite you to take part in a brief survey about your experience and the steps you have taken to prepare for retirement. (k) plans and plans are tax-advantaged retirement savings plans. (k) plans are offered by private employers, while plans are offered by state and. The chart below highlights the similarities and differences between the Plan and the (k) Plan as well as contributing on a pre-tax and Roth (after-tax). A plan includes employer matching contributions in the annual contribution limit, whereas a (k) plan does not. You can withdraw money early from a A plan includes employer matching contributions in the annual contribution limit, whereas a (k) plan does not. You can withdraw money early from a (k) plans are a popular way for employers to provide tax-favored retirement benefits for their employees. In a (k) plan, an employee can have all or a. (a) plans do not permit catch-up contributions. (b) plans have both “Age 50” and “Pre-Retirement” catch-up contribution options. This means that, after. Explain the features and benefits available through Deferred Comp — specifically the (k) and (b) plans. Distinguish between pretax and Roth savings. plans are tax-advantages retirement plans similar to (k) plans offered by local governments and certain tax-exempt employers. A (k) refers to this exception as a “financial hardship,” while a (b) plan calls it an “unforeseeable emergency.” In either case, these provisions aim to. Public-sector and nonprofit organizations don't offer their employees (k) plans. · The (b) is offered to state and local government employees, and the (k)/ Plan Comparison As a Plan participant, you should name a beneficiary(ies) to receive the value of your account balances in the and/or (k). You're ordinarily required to put in a percentage of your own pay, through salary deferral, to receive employer contributions. Highlights: The contribution. Below is a comparison of fees incurred in the City's Deferred Compensation Plan versus the fees incurred in similar institutional and retail class funds. Fee. vs (k) are common retirement options for employees. Find out how these retirement plans compare, and the key differences between them. More detailed information is available in the Plan Highlights brochure. The Benefits of Saving through PSR. It's easy – Contributions are made through easy. How a (b) plan differs from a (k) plan · There isn't an additional 10% early withdrawal tax, although withdrawals are subject to ordinary income taxes. many of the same features as the pre-tax (k), but also some key differences. See for more details on the differences between the (k) and. Plans. What is the difference between the (k) and Plans? Both the PERAPlus Do I have to wait for my employer's open enrollment period to enroll in a PERAPlus.

Vt Etf

Get the latest Vanguard Total World Stock Index Fund ETF (VT) real-time quote, historical performance, charts, and other financial information to help you. A list of holdings for VT (Vanguard Total World Stock ETF) with details about each stock and its percentage weighting in the ETF. VT | A complete Vanguard Total World Stock ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. As of July , in the previous 30 Years, the Vanguard Total World Stock (VT) ETF obtained a % compound annual return, with a % standard deviation. It. Vanguard Total World Stock ETF VT seeks to track the performance of the FTSE Global All Cap Index, which contains US and foreign stocks, both developed and. Vanguard Total World Stock Index Fund ETF Shares (VT) · What Is the Vanguard Total World Stock Ticker Symbol? VT is the ticker symbol of the Vanguard Total. ETF Phase 37 Request System – OPEN. The Phase 37 Call for Requests Memo and System User Guide is available and provides additional information. VT - Vanguard Total World Stock ETF - Stock screener for investors and traders, financial visualizations. Find the latest quotes for Vanguard Total World Stock ETF (VT) as well as ETF details, charts and news at webkeds.ru Get the latest Vanguard Total World Stock Index Fund ETF (VT) real-time quote, historical performance, charts, and other financial information to help you. A list of holdings for VT (Vanguard Total World Stock ETF) with details about each stock and its percentage weighting in the ETF. VT | A complete Vanguard Total World Stock ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. As of July , in the previous 30 Years, the Vanguard Total World Stock (VT) ETF obtained a % compound annual return, with a % standard deviation. It. Vanguard Total World Stock ETF VT seeks to track the performance of the FTSE Global All Cap Index, which contains US and foreign stocks, both developed and. Vanguard Total World Stock Index Fund ETF Shares (VT) · What Is the Vanguard Total World Stock Ticker Symbol? VT is the ticker symbol of the Vanguard Total. ETF Phase 37 Request System – OPEN. The Phase 37 Call for Requests Memo and System User Guide is available and provides additional information. VT - Vanguard Total World Stock ETF - Stock screener for investors and traders, financial visualizations. Find the latest quotes for Vanguard Total World Stock ETF (VT) as well as ETF details, charts and news at webkeds.ru

Vanguard Total World Stock ETF This ETF provides physical exposure, by owning its shares you earn the return of the securities composing the index (as the ETF. Vanguard Total World Stock Index Fund ETF Shares VT:NYSE Arca. Last Price, Today's Change, Bid/Size, Ask/Size, Today's Volume. $, +. Real time Vanguard International Equity Index Funds - Vanguard Total World Stock ETF (VT) stock price quote, stock graph, news & analysis. Latest Vanguard Total World Stock Index Fund ETF Shares (VT:PCQ:USD) share price with interactive charts, historical prices, comparative analysis. VT Price - See what it cost to invest in the Vanguard Total World Stock ETF fund and uncover hidden expenses to decide if this is the best investment for. View Vanguard Total World Stock ETF (VT) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. The VT Exchange Traded Fund (ETF) is provided by Vanguard. It is built to track an index: FTSE Global All Cap Index. The VT ETF provides physical exposure. Analysis of the Vanguard Total World Stock ETF ETF (VT). Holdings, Costs, Performance, Fundamentals, Valuations and Rating. Get comprehensive information about Vanguard Total World Stock ETF (USD) (US) - quotes, charts, historical data, and more for informed investment. Current and Historical Performance Performance for Vanguard Total World Stock Index Fund ETF Shares on Yahoo Finance. Explore VT for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. What was VT's price range in the past 12 months? VT lowest ETF price was $ and its highest was $ in the past 12 months. An easy way to get Vanguard Total World Stock Index ETF real-time prices. View live VT stock fund chart, financials, and market news. Complete Vanguard Total World Stock ETF funds overview by Barron's. View the VT funds market news. In depth view into VT (Vanguard Total World Stock ETF) including performance, dividend history, holdings and portfolio stats. Why Robinhood? Robinhood gives you the tools you need to put your money in motion. You can buy or sell VT and other ETFs, options, and stocks. Vanguard Total World Stock ETF advanced ETF charts by MarketWatch. View VT exchange traded fund data and compare to other ETFs, stocks and exchanges. Vanguard Total World Stock ETF exchange traded fund overview and insights. Get Vanguard Total World Stock Index Fund ETF Shares (VT:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC.

Car Insurance Payment Per Month

In , the average cost of car insurance is $/year which comes to $ per six-month policy or $/month. Use The Zebra to compare prices. The minimum coverages and amounts of insurance that must be purchased to No-Fault is a personal injury coverage and does not pay for auto body. The average cost of full coverage car insurance is per year, or about per month, while minimum coverage costs an average of per year, or around per month. The higher the deductible you choose, the less you'll pay. This is because your deductible is the amount subtracted from a claim check, so your insurance. The monthly average cost of car insurance for drivers in the U.S. is $ for full coverage and $53 for minimum coverage. Find quotes for your area. Your car insurance rate is affected by factors like driving history, your vehicle and more. Find out how your premium is calculated and how you can save. The cost of car insurance per month generally ranges between $ and $, depending on various factors including geographic location, car make and model. Deductible – This is the amount of money you pay out of pocket before an insurance company helps cover costs, up to the coverage limit. How can I lower my car. The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy. In , the average cost of car insurance is $/year which comes to $ per six-month policy or $/month. Use The Zebra to compare prices. The minimum coverages and amounts of insurance that must be purchased to No-Fault is a personal injury coverage and does not pay for auto body. The average cost of full coverage car insurance is per year, or about per month, while minimum coverage costs an average of per year, or around per month. The higher the deductible you choose, the less you'll pay. This is because your deductible is the amount subtracted from a claim check, so your insurance. The monthly average cost of car insurance for drivers in the U.S. is $ for full coverage and $53 for minimum coverage. Find quotes for your area. Your car insurance rate is affected by factors like driving history, your vehicle and more. Find out how your premium is calculated and how you can save. The cost of car insurance per month generally ranges between $ and $, depending on various factors including geographic location, car make and model. Deductible – This is the amount of money you pay out of pocket before an insurance company helps cover costs, up to the coverage limit. How can I lower my car. The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy.

California car insurance rates — quick facts · The average auto insurance cost in California is $1, per year — 20% more than the national average. · Drivers in. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. SmartMiles is a pay-per-mile car insurance program that can lower your monthly premium. Find out how a flexible monthly rate helps low mileage drivers save. Paying monthly can be handy when you're on a budget, but don't miss a payment. Typically, an insurance company will charge you a stiff penalty and they may even. Based on our research, the national average cost of car insurance is $72 per month for minimum coverage and $ per month for full coverage. Car insurance on average is $ per month in low-cost states, $ per month in medium-cost states, and $ per month in high-cost states. *Read the. If you don't drive a lot, you shouldn't pay much for auto insurance. With Pay-per-mile car insurance, you could save hundreds every year. Drivers in the U.S. pay an average of $1, per year for full coverage car insurance, or about $ per month, according to Bank rate's Even though once-per-year payments provide a less expensive plan, monthly payments are available and offer some benefits. Many insurance companies offer. Likewise, lower coverage limits and a higher car insurance deductible may help lower premium costs. amount to a request for services, such as setting. Average annual premium. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an. Your next car will have costs beyond the monthly payment. Here's how to estimate a car insurance premium before you buy. Updated Sep 3, · 1 min read. Paying for 6-month premium car insurance is less of a burden on your wallet than a one-time payment for 12 months of coverage. However, paying upfront is. The amount of time you spend on the road matters when determining how much coverage you may want to carry. More time driving can increase your risk of being in. Average Car Insurance Cost by Category · Minimum Coverage: $56 per month · Full Coverage: $ per month · Drivers with a Violation: $71 per month · Young Drivers. Drivers in New York pay $ per month on average for minimum-coverage car insurance. · Cheapest recent rates in New York · What's the average cost of car. Monthly Car Insurance Payments. If you Instead of paying the entire premium annually, the premium is divided by 12, and that amount is due each month. Choosing a higher deductible lowers the amount you pay for insurance, but it How can I lower my auto insurance premium? Everybody loves to save. Car insurance costs $60 per month, on average, for a minimum coverage policy, although individual rates might vary. Full coverage car insurance is more. This calculator can help you determine how much your monthly vehicle payments may be. Loan amount, loan term, and interest rate all factor into the calculation.

Debit Card Swipe For Iphone

$29 for your first card reader · Additional card readers $79 each · Yes—mobile phone or tablet with iOS/Android to connect via Bluetooth · ounces ( grams). You can accept credit card payments on an iPhone using a card reader or an app provided by your payment processor. swipe or tap their credit or debit card. Square's free credit card reader works with the free Square Point of Sale app to let everyone accept swipe payments on their smartphone or tablet. The mobile app will have a “Scan Card” option to help you pay. Simply ask your customers to press the icon and position their credit/debit card's chip before. The surge in self-service requires a payment kiosk with a card reader. Our payment kiosks combine an iPad or table stand with card readers and other chip. Save money on transaction costs every time you use a SwipeSimple Bluetooth card reader with your iOS or Android mobile device to swipe, dip, or tap credit card. Square Plug-In Credit Debit Card Reader - White for Apple iPhone and iPad charge 3% every time you use this square card swipe. Read Less. Verified. Its Square Reader is a mobile credit card swiper that plugs into your iPhone; all you need to do is open the Square POS app and swipe the card for payment. The best credit card readers for iPhone are from Clover, SumUp, Payanywhere, Square, PayPal Zettle, QuickBooks and Helcim and range in cost from $0 to. $29 for your first card reader · Additional card readers $79 each · Yes—mobile phone or tablet with iOS/Android to connect via Bluetooth · ounces ( grams). You can accept credit card payments on an iPhone using a card reader or an app provided by your payment processor. swipe or tap their credit or debit card. Square's free credit card reader works with the free Square Point of Sale app to let everyone accept swipe payments on their smartphone or tablet. The mobile app will have a “Scan Card” option to help you pay. Simply ask your customers to press the icon and position their credit/debit card's chip before. The surge in self-service requires a payment kiosk with a card reader. Our payment kiosks combine an iPad or table stand with card readers and other chip. Save money on transaction costs every time you use a SwipeSimple Bluetooth card reader with your iOS or Android mobile device to swipe, dip, or tap credit card. Square Plug-In Credit Debit Card Reader - White for Apple iPhone and iPad charge 3% every time you use this square card swipe. Read Less. Verified. Its Square Reader is a mobile credit card swiper that plugs into your iPhone; all you need to do is open the Square POS app and swipe the card for payment. The best credit card readers for iPhone are from Clover, SumUp, Payanywhere, Square, PayPal Zettle, QuickBooks and Helcim and range in cost from $0 to.

card readers. So, choose an iPhone card reader like Payment Depot's that uses the SwipeSimple app––which is compatible with both iPhone and Android devices. This company which is actually based in the UK is selling credit card readers and claims to offer merchant accounts for credit card processing at rates lower. Just connect your Payanywhere 3-in-1 Bluetooth® Credit Card Reader to your iOS or Android device and start accepting payments. PIN debit + EBT. Device. With our card reader solution you can accept mobile in-person payments using a card reader as the payment interface, and process these payments on the Adyen. Shop for bluetooth credit card reader for iphone at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Get your free app & credit card reader today. Call 1() or download the app, activate your account and have your card reader within hours. Get access to essential features to sell and run your business with the Chase POS app – take payments with Tap to Pay on iPhone or Payment links, connect to a. The PayPal Zettle card reader is a portable point-of-sale system that lets you accept debit and credit card payments from just about anywhere. Mobile Debit Credit Card Reader Square Smartphone Swipe Payment Apple Android.. eBay. Square Credit Card Reader For Apple And Android Phones New · $ Making it even easier is the option to purchase a credit card reader adapter so you can swipe cards with your iPhone. account payment, if applicable. FREE Credit Card Swiper with new merchant account. webkeds.ru Swipe is the safe and secure way to process credit cards. Universal Portable Smart Card Reader for Bank Card Card, Smart ID Credit Card Reader, USB Interface, Black. Whether Mobile or Computer attached, Card Machine Outlet offers a wide array of credit card readers. Tap your device or card. Customers can hold their devices or contactless cards near the reader for even faster payment with Apple Pay or Google Pay. Tap Connect a card reader. Turn on the card reader and make sure it's charged. Payment apps can now accept contactless payments from contactless credit or debit cards, Apple Pay, Apple Watch, and smartphones with other digital wallets. Wide Range of Payment Methods. Clover Go offers access to tap, chip, and swipe payments, making it simple to accept all types of credit cards (and mobile device. Cantaloupe card readers accept all digital payment methods, including credit/debit cards, EMV contactless, and mobile wallets to make it easy for your. SumUp is a credit card reader for iPhone and Android. The Air card reader connects via Bluetooth to Samsung Android and iPad too. Accept payments on the go with the Mobile Card Reader D, a Bluetooth® card reader that lets you take secure payments on a.

Universal Life Insurance Pros And Cons

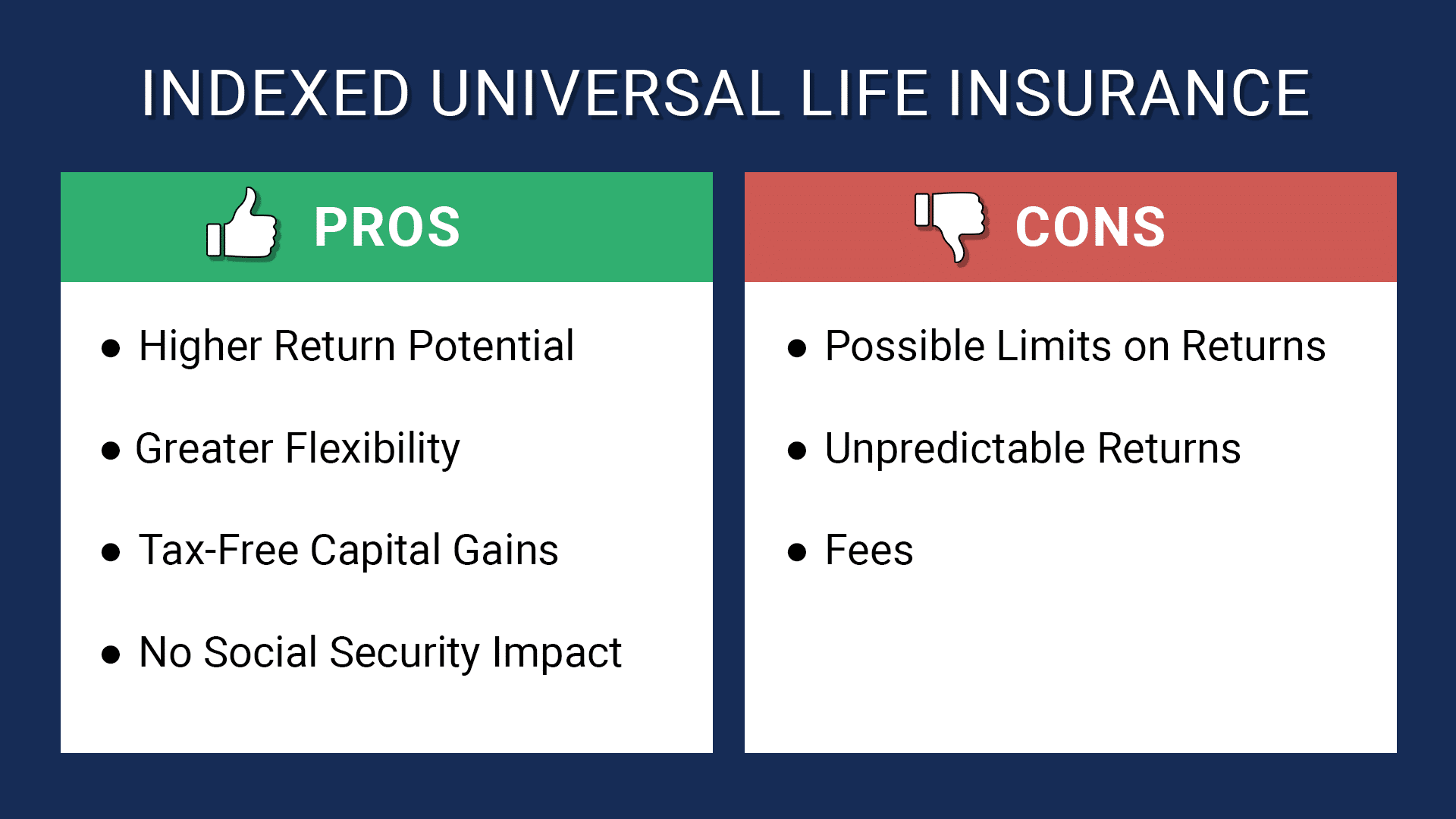

Universal life insurance is a type of permanent life insurance and carries a cash value, the premium is divided into a savings portion and an investment. Indexed Universal life insurance policies have their benefits and shortcomings like any other policy. The following are some of the IUL pros and cons we. Whole life offers more guarantees than universal life with premiums that never go up or down; universal life offers more flexibility because it features. This is a benefit for the policyholder, since even though universal life insurance has certain risks, the cash value is guaranteed to grow as long as the. Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that provides both a death benefit and a cash value component. Pros · Built-in savings or investing account funded by a portion of your premium. · Option to borrow or withdraw cash value, per policy rules. · Ability to use. Pros and Cons of Universal Life Insurance · Coverage can last a lifetime as long as premium payments don't lapse · Premiums and death benefit amounts can be. It is a permanent policy that will last your entire life, and features both a death benefit and cash value that can build up over time. Universal Life Insurance · Pros: Lower initial premiums. Simplicity and straightforward coverage. Ideal for temporary coverage needs (e.g. Universal life insurance is a type of permanent life insurance and carries a cash value, the premium is divided into a savings portion and an investment. Indexed Universal life insurance policies have their benefits and shortcomings like any other policy. The following are some of the IUL pros and cons we. Whole life offers more guarantees than universal life with premiums that never go up or down; universal life offers more flexibility because it features. This is a benefit for the policyholder, since even though universal life insurance has certain risks, the cash value is guaranteed to grow as long as the. Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that provides both a death benefit and a cash value component. Pros · Built-in savings or investing account funded by a portion of your premium. · Option to borrow or withdraw cash value, per policy rules. · Ability to use. Pros and Cons of Universal Life Insurance · Coverage can last a lifetime as long as premium payments don't lapse · Premiums and death benefit amounts can be. It is a permanent policy that will last your entire life, and features both a death benefit and cash value that can build up over time. Universal Life Insurance · Pros: Lower initial premiums. Simplicity and straightforward coverage. Ideal for temporary coverage needs (e.g.

With universal life insurance, the amount in the bucket can fluctuate. Why? The cost of insurance could go up and erode what you've put in. It's also possible. Indexed Universal Life Insurance Pros and Cons · Initial costs can be lower than Whole Life · Premiums can vary widely without triggering tax liabilities · Cash. Universal life insurance benefits · Since there is a cash value component, you may be able to skip premium payments as long as the cash value is enough to cover. The disadvantages of universal life insurance include the potential for policy lapse if not properly funded, the complexity of the policy, and fluctuating. Cons of Indexed Universal Life · Con: Index Growth Options Are Capped or Diluted · Con: IUL Complexity Requires Ongoing Understanding · Con: No Guarantees Inside. A guaranteed universal life insurance policy comes with a guaranteed death benefit and a premium amount that stays the same throughout the life of the policy. What are the disadvantages of Universal Life Insurance Compared to Term Life Insurance? Universal life insurance can seem appealing with its lifelong coverage. The cons of variable universal life insurance include complexity, higher cash needs, long time horizons and market risks. Variable universal life insurance is. What Is Whole Life Insurance? Pros: Predictable premiums. Steady, guaranteed cash value accumulation. Possible to earn dividends. Cons: Potential to miss out. Higher premiums: Universal life insurance typically has higher premiums than term life insurance, as it provides lifelong coverage and includes a cash value. Pros of Indexed Universal Life Insurance · Tax-Deferred Growth: The cash value growth in an IUL policy accumulates on a tax-deferred basis. · Cash Value Growth. What are the pros and cons of whole life insurance? · Pro: Lifelong coverage · Pro: Fixed premiums · Pro: Cash value growth · Pro: Dividends · Con: Complexity · Con. Lower Cost. When you buy a non-guaranteed universal life insurance policy, you will pay extra money each year to build your cash value. To accommodate. Indexed Universal Life Insurance Pros and Cons · Initial costs can be lower than Whole Life · Premiums can vary widely without triggering tax liabilities · Cash. Some disadvantages of getting universal life insurance include higher premiums, surrender fees, lapse potential and uncertain returns. Higher premiums: Universal life insurance typically has higher premiums than term life insurance, as it provides lifelong coverage and includes a cash value. Universal life insurance is usually more expensive than term or whole-life policies due to its higher cost structure and potential for higher returns on cash. The 15 ways universal life insurance is used list includes providing financial security for a family and protecting key people in business. Universal Life Insurance Advantages and Disadvantages Some of the greatest benefits of choosing a universal life insurance policy are that you have more input. What are the pros and cons of variable universal life insurance? · VUL gives you lifelong protection for the people you love, along with premium and death.

Etoro Daily Trading

Trade and invest in a diversified portfolio, or practice risk-free with a virtual portfolio. Join eToro's 35M user community today. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. The 7 Best Stock Market Simulators (Free. People say it is but scalping isn't. On the other hand in eToro FAQ it's stated that it's limited to 4 day trades in 5 consecutive days. So. talking about this. The world's leading social investment network. Content provided by eToro 🎙️ Kick off your day with market analyst Sam North on The. Now eligible accounts can earn interest on cash! OPTIONS TRADING LIKE NEVER BEFORE eToro Options removes the commissions, contract fees, and jargon to make. eToro is a multi-asset, social investment platform which offers investing in both stocks and digital assets, as well as trading CFDs. Does eToro Allow Day Trading? Yes, eToro allows day trading, and many traders utilize the platform for this purpose. From leverage to tools like ProCharts, the. A virtual account on eToro replicates the same features and market conditions as a real investing account, but it's used for simulation purposes only. It is. A Pattern Day Trading (PDT) account is any margin account that has placed more than 3 day trades in a rolling 5 business day period. Trade and invest in a diversified portfolio, or practice risk-free with a virtual portfolio. Join eToro's 35M user community today. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. The 7 Best Stock Market Simulators (Free. People say it is but scalping isn't. On the other hand in eToro FAQ it's stated that it's limited to 4 day trades in 5 consecutive days. So. talking about this. The world's leading social investment network. Content provided by eToro 🎙️ Kick off your day with market analyst Sam North on The. Now eligible accounts can earn interest on cash! OPTIONS TRADING LIKE NEVER BEFORE eToro Options removes the commissions, contract fees, and jargon to make. eToro is a multi-asset, social investment platform which offers investing in both stocks and digital assets, as well as trading CFDs. Does eToro Allow Day Trading? Yes, eToro allows day trading, and many traders utilize the platform for this purpose. From leverage to tools like ProCharts, the. A virtual account on eToro replicates the same features and market conditions as a real investing account, but it's used for simulation purposes only. It is. A Pattern Day Trading (PDT) account is any margin account that has placed more than 3 day trades in a rolling 5 business day period.

eToro Day Trading Platform for Beginners eToro is a well-known day trading platform that provides a variety of tools and features to assist traders in making. eToro's posts ; · ; In this Market Bites episode, market analyst · 5. 16 ; 3 painful September truths: · 6. 89 ; · ; Our experts shared key insights. eToro offers the possibility to trade cryptocurrencies, stocks, commodities, forex, indices and ETFs from anywhere in the world. Best Day Traders to Copy on eToro · Riccardo Gregori · Vakhtang Mindiashvili · Pawel Lech Cylkowski. FINRA defines a day trade as the purchase and sale or the sale and purchase of the same security (stock, ETF, etc.) on the same day. eToro's trading platform offers real-time data, news updates, and live price charts, essential for traders at every level. These tools are particularly. With innovative investment tools and a collaborative trading community, eToro empowers millions of users in over countries to trade and invest in a simple. Daily Movers ; PL. Planet Labs PBC. % ; RENT. Rent the Runway. % ; SOAR. Volato Group Inc. % ; SLNAF. Selina Hospitality PLC. % ; BRZE. Braze. The next generation of investing is here: eToro's innovative smart portfolios are ready-made, fully allocated portfolios utilising cutting-edge technology to. Learn about forex scalping, swing trading and day trading. Discover how each approach works and decide which will best position you to meet your investment. The US stock markets are typically open from am to 4pm ET during normal business days (Monday to Friday). On bank holidays, the markets are either closed. Invest with the multi-asset platform that revolutionized trading. Join millions of investors worldwide who share their ideas and strategies in a community. The best eToro trading strategies include copy-trading, fundamental analysis, and technical analysis. On today's Daily Voice, Sam reviews how Nvidia suffered the biggest one-day loss of a stock (by market cap) of all time, the weak US data & previews the. There is a 1% fee for buying or selling cryptoassets on eToro. This 1% fee is added to the market price (bid-ask spread) and is included in the price we show. I'm an Etoro user for six months. I tried everything from day trading, copy trading to simply investing. And I think it's one of the best. Bringing you the most comprehensive Trading Journal for eToro. The trading journal was built by traders struggling to track what was working and what was not. Steps to get started · Choose a trading platform: Opt for a reputable platform like Etoro for a user-friendly experience and diverse assets. eToro isn't for everyone. While it's great for time-poor beginner and intermediate investors, it's suboptimal for people who want to become serious day traders.

How Much Is A Stock Tesla

Name, Value ; Name, Tesla, Inc. stocks CFD ; 1 Pip Size, ; Size of 1 lot, contracts ; Minimum spread (pips), 0. Markets. If You'd Invested $10, in Tesla Stock 5 Years Ago, Here's How Much You'd Have Today. 1 day ago • The Motley Fool. Stocks. QQQ ETF Update, 9/13/ Tesla Inc TSLA:NASDAQ ; Close. quote price arrow up + (+%) ; Volume. 57,, ; 52 week range. - Real-time Price Updates for Tesla Inc (TSLA-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. Tesla Inc · Business Description · GF Value: $ · Valuation Chart · Warning Signs · Financial Strength · Profitability Rank · GF Value Rank · Growth Rank. How do I purchase shares of Tesla? · Can Tesla comment on a move in its share price or provide investment advice? · Does Tesla pay a dividend? · When was Tesla's. Discover real-time Tesla, Inc. Common Stock (TSLA) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Looking ahead, we forecast Tesla to be priced at by the end of this quarter and at in one year, according to Trading Economics global macro models. Tesla Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Name, Value ; Name, Tesla, Inc. stocks CFD ; 1 Pip Size, ; Size of 1 lot, contracts ; Minimum spread (pips), 0. Markets. If You'd Invested $10, in Tesla Stock 5 Years Ago, Here's How Much You'd Have Today. 1 day ago • The Motley Fool. Stocks. QQQ ETF Update, 9/13/ Tesla Inc TSLA:NASDAQ ; Close. quote price arrow up + (+%) ; Volume. 57,, ; 52 week range. - Real-time Price Updates for Tesla Inc (TSLA-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. Tesla Inc · Business Description · GF Value: $ · Valuation Chart · Warning Signs · Financial Strength · Profitability Rank · GF Value Rank · Growth Rank. How do I purchase shares of Tesla? · Can Tesla comment on a move in its share price or provide investment advice? · Does Tesla pay a dividend? · When was Tesla's. Discover real-time Tesla, Inc. Common Stock (TSLA) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Looking ahead, we forecast Tesla to be priced at by the end of this quarter and at in one year, according to Trading Economics global macro models. Tesla Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range -

The week high price of Tesla Inc (TSLA) is $ The week low price of Tesla Inc (TSLA) is $ Browse our live Tesla share price chart to get all the information you need on TSLA stock today. Tesla, Inc, formerly known as Tesla Motors, Inc, is an. Market cap: $ Billion As of September Tesla has a market cap of $ Billion. This makes Tesla the world's 12th most valuable company by market. View Tesla Motors share pricing chart, leverage info, latest research and price drivers. Trade Tesla Motors shares at webkeds.ru The Tesla Inc stock price today is What Is the Stock Symbol for Tesla Inc? The stock symbol for Tesla Inc is "TSLA." What Stock Exchange Does Tesla Inc. One can easily invest in Tesla Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification. Interactive chart of historical stock value for Tesla over the last 10 years. The value of a company is typically represented by its market capitalization. Tesla Price: for Sept. 13, · Price Chart · Historical Price Data · Price Definition · Price Range, Past 5 Years · Price Benchmarks · Price Related Metrics. Thinking of buying or selling Tesla Inc stock that's listed in a currency different from your local one? Use our international stock ticker to check and. How much is Tesla worth? TSLA has a market cap of $ billion. This is considered a Mega Cap stock. How much money does Tesla make. 1-year stock price forecast ; High $ % ; Median $ % ; Low $ %. Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. Tesla (TSLA) has a Smart Score of 3 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. Access real-time $Tesla Motors, Inc. stock insights on eToro. ➤ View prices, charts, and analyst price target ✓ Invest in TSLA Now. Tesla Stock 5 Years Ago, Here's How Much You'd Have Today · TSLA +%. If You'd Invested $10, in Tesla Stock 5 Years Ago, Here's How Much. CNBC · 6. The intrinsic value of one TSLA stock under the Base Case scenario is USD. Compared to the current market price of USD, Tesla Inc is Overvalued by. Tesla is a vertically integrated battery electric vehicle automaker and developer of autonomous driving software. Find new and used Tesla cars. Every new Tesla has a variety of configuration options and all pre-owned Tesla vehicles have passed the highest inspection. Tesla · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (% YoY). Tesla, Inc. engages in the design, development, manufacture, and sale of fully electric vehicles, energy generation and storage systems. It also provides.

Offshoring Accounting Services

TOA Global provides outsourced accounting services to + leading firms in the US, Canada, Australia, & New Zealand. Hire elite talent today! We define Outsourced Accounting & Bookkeeping as having an external accounting department manage your in-house accounting needs. Consider an accounting company. Offshoring accounting services enables access to proficient professionals at a reduced expenditure, and that ensures the precision and timeliness of financial. CBIZ offers a multitude of accounting advisory and outsourced accounting services that make it easier for you to focus on your core operations. End-To-End Accounting Outsourcing Services USA. We at Whiz Consulting have provided online accounting services to USA Businesses for over a decade now, and we. So, what is offshore accounting? Offshore accounting for accounting firms involves hiring skilled professionals in different geographic regions. A Trusted offshoring partner provides outsourced accounting services to + US & Canadian firms. Hire talent from India, Philippines starting at $11/hour. Accounting firms need to embrace offshoring to find great talent and work more effectively. Ask TOA Global about offshoring for accounting firms today. Offshoring elevates outsourcing to a global scale. By tapping into professionals worldwide, firms gain expertise at a fraction of the local cost. TOA Global provides outsourced accounting services to + leading firms in the US, Canada, Australia, & New Zealand. Hire elite talent today! We define Outsourced Accounting & Bookkeeping as having an external accounting department manage your in-house accounting needs. Consider an accounting company. Offshoring accounting services enables access to proficient professionals at a reduced expenditure, and that ensures the precision and timeliness of financial. CBIZ offers a multitude of accounting advisory and outsourced accounting services that make it easier for you to focus on your core operations. End-To-End Accounting Outsourcing Services USA. We at Whiz Consulting have provided online accounting services to USA Businesses for over a decade now, and we. So, what is offshore accounting? Offshore accounting for accounting firms involves hiring skilled professionals in different geographic regions. A Trusted offshoring partner provides outsourced accounting services to + US & Canadian firms. Hire talent from India, Philippines starting at $11/hour. Accounting firms need to embrace offshoring to find great talent and work more effectively. Ask TOA Global about offshoring for accounting firms today. Offshoring elevates outsourcing to a global scale. By tapping into professionals worldwide, firms gain expertise at a fraction of the local cost.

We help finance and accounting teams transform internal processes, increase efficiency, and improve decision-making. Aprio provides cloud accounting outsourcing, technology, tax, Virtual CFO, and other CPA advisory services to US and global businesses. With + professionals and + nonprofit clients and counting, we are the nation's premier accounting services practice focused on the nonprofit and social. - Security Issues. Outsourced bookkeeping services have to be able to provide top-notch security for the transmission and the storage of your company's. CapActix is Offshore Accounting Company having expertise in providing finance and accounting outsourcing services in the USA from bookkeeping to virtual CFO. We can outsource all or most of your finance and accounting functions, so you can focus more on your business and less on your back office. Also, we can help. We are a team of accountants, CFOs, and financial data analysts who use real-time data and reporting to give you insights and strategies for financial growth. Jitasa is our top choice for an outsourced nonprofit accounting firm, offering a wide range of services that help nonprofits take their finances to the next. KMK offers top-tier Offshore Bookkeeping & Accounting Services for small businesses, startups & CPA firms at cost-effectiveness rates. Startupfino is a company that specialises in offering complete services for accounting outsourcing services. What Accounting Services Can You Offshore? · Bookkeeping · Preparation of financial statements · Payroll · Accounts payable and receivable · Tax preparation and. There are ways to quickly evaluate cost-effective, offshore solutions so you don't have to hire and train an in-house accounting team. Another significant benefit of outsourcing your accounting and finance is cost savings. When it comes to employees, all of the costs must be considered. These. We will rank the top 10 outsourced accounting services firms that offer high-quality, affordable, and customized solutions for your business in Safebooks Global is an offshore firm providing experienced accounting teams to small and medium-sized CPA and EA firms throughout the United States. Our team of. Prior to the pandemic, about % of accounting firms used offshore staffing, post-pandemic that number grew to % with many more firms not. Why Choose Fin-eX Outsourcing? Quality Service. The best quality service at the most competitive rates. Fin-eX offers outsourcing solutions to various. You want to run your business and focus on the overall growth and vision of the company itself. This is why having an outsourced accounting team has the. Get highly qualified and experienced full-time accountants to work nearshore from our office in Mexico. Simplify tax preparation processing, accelerate turnaround and increase client satisfaction while stabilizing staff bandwidth with Xpitax® Outsourcing Services.