webkeds.ru

Market

Fundrise Business Model

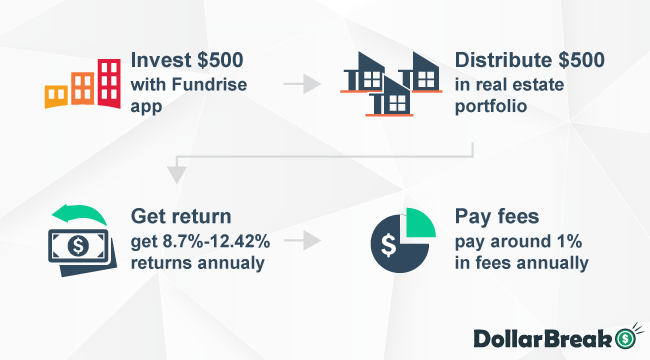

The business model of Fundrise revolves around connecting individual investors with real estate opportunities that were historically only accessible to a select. Fundrise Real Estate Investment Trust, LLC is a recently organized Delaware limited liability company formed to originate, invest in and manage a diversified. Fundrise is the first investment platform to create a simple, low-cost way for anyone to access real estate's historically consistent, exceptional returns. Accredited investors can buy pre-IPO stock in companies like Fundrise through EquityZen funds. These investments are made available by existing Fundrise. To quote them in their own words, "armed with a revolutionary business model, disruptive technology, and world-class real estate, Fundrise is on a mission to. One of the keys to our business model is our ability to ruthlessly minimize fees by eliminating typical industry inefficiencies. investment on the Fundrise. Fundrise eliminates the traditional barrier to real estate investing which is allowing nonaccredited investors access to private real estate deals. Fundrise, one of the first direct-to-consumer real estate investment platforms, needed to build their business by finding new customers. Through the use of the Fundrise Platform, investors can browse and screen real estate investments, view details of an investment and sign legal documents online. The business model of Fundrise revolves around connecting individual investors with real estate opportunities that were historically only accessible to a select. Fundrise Real Estate Investment Trust, LLC is a recently organized Delaware limited liability company formed to originate, invest in and manage a diversified. Fundrise is the first investment platform to create a simple, low-cost way for anyone to access real estate's historically consistent, exceptional returns. Accredited investors can buy pre-IPO stock in companies like Fundrise through EquityZen funds. These investments are made available by existing Fundrise. To quote them in their own words, "armed with a revolutionary business model, disruptive technology, and world-class real estate, Fundrise is on a mission to. One of the keys to our business model is our ability to ruthlessly minimize fees by eliminating typical industry inefficiencies. investment on the Fundrise. Fundrise eliminates the traditional barrier to real estate investing which is allowing nonaccredited investors access to private real estate deals. Fundrise, one of the first direct-to-consumer real estate investment platforms, needed to build their business by finding new customers. Through the use of the Fundrise Platform, investors can browse and screen real estate investments, view details of an investment and sign legal documents online.

By pooling investor funds, Fundrise is able to invest in a variety of real estate assets such as commercial properties, residential properties, and even large-. Fundrise and its family of funds have reporting stan- dards similar to those of publicly traded companies. Active Publicly Reporting Offerings. 1. Rise. Fundrise allows individual investors to buy shares in real estate investment trusts (REITs). With a $10 minimum investment, it significantly lowers the barrier. Fundrise gives individuals the ability to invest directly in local properties without the unnecessary fees and middlemen of conventional real estate equity. “Fundrise is opening the gates to this most privileged of enclaves, marshaling a business model that melds PE-like funds and fintech to help people buy real. So, in , Fundrise transitioned to a funds-based model, which initially resulted in losing half their customers but later unlocked vast. Build wealth—Fundrise's growth-focused portfolios intend to buy and hold long-term assets with exceptional potential for appreciation. Preserve wealth—. investments over time, and are not actual Fundrise customer or model returns or projections. Past performance is no guarantee of future results. Any. By aligning its revenue model with investor returns, Fundrise aims to create a win-win situation where the platform's success is directly tied to the success of. Fundrise's growth as a direct to investor, alternative asset management company. Again, very fundamental to our business model and to the alternative asset. It appears to be a smart business model and so far they've cautious snd conservative with our money. I have over 20k in there, I'm at over. Invest in tomorrow's great tech companies, today · Portfolio companies · Why Venture · About the fund · The Fundrise Difference · Additional reading · Investment in. Fundrise is the largest direct-to-investor platform and allows individuals to access alternative assets like real estate, venture capital, and private credit. Fundrise was founded in and attracted around $M of investments in 7 rounds of fundraising. As a monetization model, Fundrise chose to charge. 6. 17 - Fundrise is a pioneering real estate investment platform that leverages technology to democratize access to high-quality real. With deep industry expertise and a dedication to market fundamentals, we've honed a strategy that captures real estate's famed potential for stable returns. Fundrise also offers fractional real estate investments, which allow investors to buy a small share of a property. Fundrise uses a more passive investment model. For example, while Fundrise initially began as a platform dedicated to real estate investment, over time, the company diversified its offerings. As a result. Yes, even their Starter Plan and Long-Term Growth investment plan pay dividends. You can receive them as cash deposited in your bank account or reinvest them. Founded in , Fundrise pioneered the eREIT asset, a private diversified real estate investment trust that enables everyday people to invest in private real.

Va Loan Lenders Near Me

NerdWallet's Best VA Mortgage Lenders of September · Veterans United · NBKC · Guaranteed Rate · Rocket Mortgage, LLC · Flagstar · PenFed · USAA · Navy. Find the top mortgages near you. Get accurate quotes from both traditional While all VA loans are backed by the VA, individual lenders offer mortgages. We'll make it easy. You make it home. We've streamlined VA homebuying — so you can buy your first or fifth home with confidence. Rocky Mountain Mortgage Company provides professional mortgage lenders with dedicated home lending services for service members and military veterans. Conventional, FHA, VA, Jumbo, ARM, Refinancing, Home Equity, HELO Show More. Mortgage Rates. Higher than industry average. Compare these top mortgage lenders to find the right VA loan for you. Here are the best VA mortgage lenders to consider. Get answers to your questions about the VA-guaranteed home loan program by contacting a VA home loan representative at Other veterans are sharing their stories. CalVet is awesome!!! They kept me updated with the loan process and were always available to answer any questions I. Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility. NerdWallet's Best VA Mortgage Lenders of September · Veterans United · NBKC · Guaranteed Rate · Rocket Mortgage, LLC · Flagstar · PenFed · USAA · Navy. Find the top mortgages near you. Get accurate quotes from both traditional While all VA loans are backed by the VA, individual lenders offer mortgages. We'll make it easy. You make it home. We've streamlined VA homebuying — so you can buy your first or fifth home with confidence. Rocky Mountain Mortgage Company provides professional mortgage lenders with dedicated home lending services for service members and military veterans. Conventional, FHA, VA, Jumbo, ARM, Refinancing, Home Equity, HELO Show More. Mortgage Rates. Higher than industry average. Compare these top mortgage lenders to find the right VA loan for you. Here are the best VA mortgage lenders to consider. Get answers to your questions about the VA-guaranteed home loan program by contacting a VA home loan representative at Other veterans are sharing their stories. CalVet is awesome!!! They kept me updated with the loan process and were always available to answer any questions I. Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility.

NewDay USA is a VA home loan mortgage lender that offers streamline refinance, zero down loan, and other options for qualified Veterans. Contact Me |. Menu. Loading Loan Types · VA Loan · State; Kentucky MI is designed to protect lenders in the event that the borrower defaults on their loan. home financing from lenders. FHA mortgage loan features. Low down payment Is there a special program available to me? How does my credit rating. nearby like shopping and entertainment, and the Appraisal - Lenders require an appraisal to ensure there is sufficient collateral for a home loan. Explore Navy Federal Credit Union's VA home loan rates and learn more about loan options to make your dream home a reality. Get preapproved today! Learn about local Veterans Administration (VA) guaranteed mortgage loans with Orrstown Bank. Contact our lenders and receive same-day pre-qualification! loans). VA loans South Carolina - VA Loan near me. Benefits of a VA Home Loan in South Carolina. Why should you think about a VA loan over all your other. Home / Program Offices / Housing / Single Family / Lenders / Lender List. HUD Find a HUD office near you. Agency icons. USDA loans and VA loans are two types of mortgages that allow borrowers to buy homes with zero down payment. Here are 5 lenders that offer them. Typically, the VA will insure 25% of the loan. Contact BrickWood Mortgage at () to learn more and get started. Lenders like USAA and Veterans United don't have stellar reputations (deservedly), and it doesn't matter that they claim to specialize in VA loans. Can you tell me any more about the requirements of a Joint Loan /Va loan? I am a vet, and would like to take out a VA loan with my non-vet. Top 10 Best Mortgage Lenders in Locust Grove, VA - July - Yelp - Embrace Home Loans, The Frye Team - Fredericksburg Mortgages, CapCenter. Home | Service Member, Veteran, or Military Spouse? You might be able to buy a home with the VA Home Loan Benefit. That's where we come in! School Locator · Principles of Excellence. Closed Arrow Education Programs Closed Arrow Lenders. Lenders Page · Lenders Sample Documents · How to Apply for. School Locator · Principles of Excellence. Closed Arrow Education VA» Veterans Benefits Administration» VA Home Loans» Lenders Page» Lender Statistics. Still, VA lenders need official paperwork in order to process a loan Can the VA Loan help me lower my monthly bills? The VA home loan program. A Texas VA home loan is a mortgage option specifically designed for eligible They provide timely updates to me and my buyers from the start of the loan. Best VA Mortgage Lenders of · What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City.