webkeds.ru

Learn

Biggest Affiliate Marketing Companies

All Affiliate Marketing Agencies · certified-flag verified-flag. 1. LeadDyno - Best for eCommerce affiliate marketing · 2. CJ Affiliate - Best for partnering with large corporations · 3. Amazon Associates - Best for monetizing. Top Affiliate Marketing Companies. Choose the right Affiliate Marketing Companies using real-time, up-to-date company reviews from verified user reviews. Amazon Associates, ShareASale, and CJ Affiliate are among the most popular affiliate networks. Amazon Associates offers access to a vast range of products with. Best Performers in Russia for Affiliate Marketing in · Skobeev & Partners · Webest · Samchuk · webkeds.ru · i-Media · Trilan Group · Ingate Digital Agency. List of the Best Affiliate Marketing Agencies · firststars GmbH · PERFORMANCE ONE AG · SaphirSolution · Nabenhauer Consul · webkeds.ru - In · SEO-Küche. Top 10 Affiliate Marketing Companies in · 1. SEO Discovery · webkeds.ru · 2. ClickBank · webkeds.ru · 3. About the program: Adam & Eve is the nation's largest marketer of adult products with millions of satisfied customers in the United States and all over the. Top Affiliate Marketing Agencies to Partner With in · 1. Perform[cb] · 2. Hamster Garage · 3. PartnerCentric · 4. Viral Nation · 5. Versa Marketing · 6. All Affiliate Marketing Agencies · certified-flag verified-flag. 1. LeadDyno - Best for eCommerce affiliate marketing · 2. CJ Affiliate - Best for partnering with large corporations · 3. Amazon Associates - Best for monetizing. Top Affiliate Marketing Companies. Choose the right Affiliate Marketing Companies using real-time, up-to-date company reviews from verified user reviews. Amazon Associates, ShareASale, and CJ Affiliate are among the most popular affiliate networks. Amazon Associates offers access to a vast range of products with. Best Performers in Russia for Affiliate Marketing in · Skobeev & Partners · Webest · Samchuk · webkeds.ru · i-Media · Trilan Group · Ingate Digital Agency. List of the Best Affiliate Marketing Agencies · firststars GmbH · PERFORMANCE ONE AG · SaphirSolution · Nabenhauer Consul · webkeds.ru - In · SEO-Küche. Top 10 Affiliate Marketing Companies in · 1. SEO Discovery · webkeds.ru · 2. ClickBank · webkeds.ru · 3. About the program: Adam & Eve is the nation's largest marketer of adult products with millions of satisfied customers in the United States and all over the. Top Affiliate Marketing Agencies to Partner With in · 1. Perform[cb] · 2. Hamster Garage · 3. PartnerCentric · 4. Viral Nation · 5. Versa Marketing · 6.

Popular startups, companies & organizations by highest day trend score: ; BrightFunded Logo. BrightFunded. —. , ; FUZEADS Logo. FUZEADS. —. , The eBay Partner Network is one of the largest affiliate marketing platforms and has over million users and categories to choose from. It's one of the. The Top 10 Richest Affiliate Marketers in the World + Strategies on Becoming a Successful Affiliate Marketer · 1. Pat Flynn · 2. John Chow · 3. Jeremy Schoemaker. Over , companies are using Affiliate Marketing tools. Outbrain with % market share (36, customers), ShareASale with % market share (29, Some of the most robust affiliate marketing companies right now include Amazon Associates, CJ Affiliate, ShareASale, Clickbank, JVZoo, and Awin. Top Affiliate Networks To Consider · ShareASale · Awin · Amazon Associates · CJ Affiliate · Rakuten Advertising · Avangate Affiliate Network · ClickBank · Peerfly. The Best Affiliate Marketing Programs (Overall) · Pepperjam · 9. MaxBounty · 8. Rakuten LinkShare · 7. Shareasale · 6. Affiliaxe · 5. ClickFunnels · 4. 10 Best Affiliate Programs for · Best Affiliate Programs: A Rundown · DFO Global/VerveDirect · ClickBank · MaxWeb · BuyGoods · Digistore24 · GiddyUp. The top 10+ most popular affiliate programs · Amazon Associates — The most versatile product selection · PartnerStack — The best for B2B · Awin — The easiest to. Top 5 Companies using Affiliate Marketing · What is Affiliate Marketing? · 1- Amazon Associates · 2- webkeds.ru · 3- Click Bank · 4- Rakuten · 5- eBay. Good Affiliate Programs for Marketing Agencies · webkeds.ru · webkeds.ru The 40 best affiliate programs of · Hubspot · Amazon Associates · eBay Partner Network · webkeds.ru · Jotform · PartnerStack · Clickbank · Rakuten. Our Reviews of the Best Affiliate Marketing Agencies: · Partner Commerce · Growann · Our Opinion on Growann · Hamster Garage · PartnerCentric · All Inclusive. Discover Best Top 21 Affiliate Networks & Marketing Platforms List · TerraLeads · OpenAFF · Magic Click · Rainmaker · webkeds.ru · Offerrum · Adsterra · CPALead. CJ is probably the biggest affiliate network, having thousands of affiliate marketing programs to choose from, that is kinda known worldwide. The dashboard. Best Affiliate Marketing Programs For Beginners · 1 Amazon Associates · 2 CJ · 3 ShareASale · 4 ClickBank · 5 Rakuten Advertising · 6 Impact · 7 Awin · 8 Etsy. Some of the biggest brands like Shopify, Thrive Market, Tonal, and JamCity use it to grow their affiliate programs. tune affiliate partner marketing platform. Top 20 Affiliate Networks to Check Out · #1 Amazon Associates · #2 ShareASale · #3 Awin · #4 Skimlinks · #5 Pepperjam · #6 Avangate · #7 FlexOffers · #8 CJ Affiliate. The Best of August · 1. Ikon Digital Media Logo. Ikon Digital Media · Get connected with a company for free. Tell us about your project, and we'll match. Biggest Affiliate Networks Based On Active Publisher Sites · CJ Affiliate (%) · Awin (%) · Rakuten (%) · Tradedoubler (%) · Impact (%) · Pepperjam .

Can I Get A Car Loan Before Filing Chapter 7

If you are making payments on a car, filing a Chapter 7 bankruptcy provide three options. You can surrender the car back to the creditor and walk away from the. The good news is that this loan shortfall can be discharged in bankruptcy, whether a Chapter 7 or a Chapter Arizona law says that to validly create and enforce a lien on a vehicle, the lien must be recorded within 30 days of purchase of the vehicle. The Chapter 13 bankruptcy auto financing process is more streamlined with your discharge papers in hand. All you have to do is apply with a dealership that's. In practice, however, car loan lenders won't return the car without an order from the court, which usually means you'll need help from a lawyer. Once you have. Why is this a problem in bankruptcy? Because if you buy a car in someone else's name and make payments on it, then the court will think that you have been. Filing on your credit history, doesn't mean you won't qualify for a car loan. We will be happy to work with your current credit and get you a great car. If you are making payments on a car, filing a Chapter 7 bankruptcy provide three options. You can surrender the car back to the creditor and walk away from the. If you file a Chapter 7 bankruptcy and are behind on your car loan payments, the lender cannot repossess your vehicle or try to collect it another way. If you are making payments on a car, filing a Chapter 7 bankruptcy provide three options. You can surrender the car back to the creditor and walk away from the. The good news is that this loan shortfall can be discharged in bankruptcy, whether a Chapter 7 or a Chapter Arizona law says that to validly create and enforce a lien on a vehicle, the lien must be recorded within 30 days of purchase of the vehicle. The Chapter 13 bankruptcy auto financing process is more streamlined with your discharge papers in hand. All you have to do is apply with a dealership that's. In practice, however, car loan lenders won't return the car without an order from the court, which usually means you'll need help from a lawyer. Once you have. Why is this a problem in bankruptcy? Because if you buy a car in someone else's name and make payments on it, then the court will think that you have been. Filing on your credit history, doesn't mean you won't qualify for a car loan. We will be happy to work with your current credit and get you a great car. If you are making payments on a car, filing a Chapter 7 bankruptcy provide three options. You can surrender the car back to the creditor and walk away from the. If you file a Chapter 7 bankruptcy and are behind on your car loan payments, the lender cannot repossess your vehicle or try to collect it another way.

When you file for Chapter 7, your car loan will not be discharged because it is not an unsecured debt, but rather a secured debt. In this type of bankruptcy. Unsecured creditors, such as those you pay your car loan to, must be paid as much as they would in Chapter 7 liquidation. Cramdown your Car Loan. If you have. If you opt for Chapter 7 bankruptcy, the car loan may be discharged In a Chapter 13 bankruptcy, you can include the car loan in your debt repayment. If your car has been repossessed, you can get the car back by promptly filing bankruptcy. You need to act before the car is sold at auction. If you own a. In most cases, you can qualify for a car loan shortly after receiving your bankruptcy discharge. If you have a decent amount of income, many car dealers will be. Almost everyone who files Chapter 7 bankruptcy wants to also begin the process for reaffirming their car loan. When reaffirming a car loan. This form tells the court what you plan to do with your car loan—whether you'll keep making payments, pay it off early, or return the car. If you don't fill out. Chapter 7 Bankruptcy and Auto Loans If you need a car loan, it's much better to wait until your Chapter 7 bankruptcy has been discharged before you apply. A. Filing bankruptcy will not make you lose your car. In fact, if you are facing repossession, you could hold off a repossession by filing. If you want to give the car back, you can do so and discharge any remaining “car deficiency”. If the car was returned or repossessed before filing bankruptcy. You can buy a car immediately after a bankruptcy discharge. You may have to pay cash for the car or pay an exorbitantly high interest rate. Chapter 13 allows people to continue to pay their car loan, and other debt under a structured plan. Both, though, have a lot of steps for those who want to keep. Creditors cannot refuse to accept payment on the car loan if you file chapter If you get behind on your car, and the creditor won't work with you. In part, this is because the vehicle finance companies are aware that a consumer can only file a chapter 7 bankruptcy once every 8 years. In addition, they know. You have to wait at least a few days before filing (otherwise the lien may not be properly "perfected," which can cause issues), but, generally. To make the most of your fresh start, let Day One help find you a Chapter 7 Bankruptcy car loan to get a better car with lower miles that will cost you less in. In fact, it is both possible and even advantageous to buy a car after filing for that Chapter 7 or Keep in mind, however, that bankruptcy courts impose. You continue to make your regular payments and you keep your car. A reaffirmation agreement is a good way to keep your car through bankruptcy, but there are. Some people buy vehicles within a few weeks or months of a Chapter 7 bankruptcy discharge. Financing a vehicle is one way to begin rebuilding your credit. From the finance strategists website, yes, auto loans are possible while in bankruptcy, although the process can be complex and challenging.

Raise The Rates

Welcome to the I Raise the Rates Community Champion Guide! This guide will provide education and resources to help you implement interventions to promote. Price updates · My plan's price increased already recently, why are you increasing it again? · When will Spotify start charging existing Premium subscribers the. When interest rates increase, it affects the ways that consumers and businesses can access credit and plan their finances. The Federal Reserve wants the inflation rate between 2–3% and will keep raising interest rates until it achieves that target when the. The Federal Reserve has raised its benchmark interest rate by %. While we don't know for sure what moves the Fed will make with interest rates this year. theSkimm. How high rates will go is anyone's guess. The Fed has hinted that it's open to raising rates again if necessary. The rate increases may help keep. Central banks often adjust interest rates according to inflation. Raising and lowering interest rates may help manage inflationary pressures on the economy. improve life for underserved communities. Learn more by reading our strategy Rate/Range EFFR Volume. Reference Rates Historical Data Search. Note. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for. Welcome to the I Raise the Rates Community Champion Guide! This guide will provide education and resources to help you implement interventions to promote. Price updates · My plan's price increased already recently, why are you increasing it again? · When will Spotify start charging existing Premium subscribers the. When interest rates increase, it affects the ways that consumers and businesses can access credit and plan their finances. The Federal Reserve wants the inflation rate between 2–3% and will keep raising interest rates until it achieves that target when the. The Federal Reserve has raised its benchmark interest rate by %. While we don't know for sure what moves the Fed will make with interest rates this year. theSkimm. How high rates will go is anyone's guess. The Fed has hinted that it's open to raising rates again if necessary. The rate increases may help keep. Central banks often adjust interest rates according to inflation. Raising and lowering interest rates may help manage inflationary pressures on the economy. improve life for underserved communities. Learn more by reading our strategy Rate/Range EFFR Volume. Reference Rates Historical Data Search. Note. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for.

The Fed has kept rates steady since July of , though a cut may be coming before the end of the year.

Here's a case study of how I successfully raised prices 50% on my primary service—a monthly coaching retainer—in mid First, put yourself in your client's shoes, ask yourself a few questions, and consider whether your rate change is really fair. The size of your monthly bill is determined by how much electricity you use and by rates approved by the Florida Public Service Commission (PSC). A collaborative, data-driven campaign to support patients, physicians, health care teams, systems, and communities in raising adult immunization rates. Central banks often adjust interest rates according to inflation. Raising and lowering interest rates may help manage inflationary pressures on the economy. To combat inflation, the rate was raised 11 times between March and July Inflation has cooled, but the Fed has signaled it wants more positive data. How are increases to the state minimum wage be determined after the minimum wage reached $15 an hour? After the state minimum wage reached $15 an hour, the rate. They noted that inflation was trending towards the Fed's 2% target, but also raised concerns about the accuracy of payroll gains and risks to the labor market. See Minimum wage increase schedule. Pennsylvania. Basic Minimum Rate (per hour): $ Premium Pay After Designated Hours: Weekly - More in Interest Rates. U.S. Treasuries. Access the most liquid markets for improve the performance of our site. They help us to know which pages are. Prime is one of several base rates used by banks to price short-term business loans. 8. The rate charged for discounts made and advances extended under the. Here are seven simple strategies to help you raise your rates and earn more – without losing your clients. All pages in this section. Euro exchange rates · Key ECB interest rates We are always working to improve this website for our users. To do this, we. Since , Social Security general benefit increases have been cost-of-living adjustments or COLAs. When inflation is high, the Fed will increase rates to increase the cost of borrowing and cool demand in the economy. If inflation is too low, they'll lower. The Fed is now faced with a new challenge: It needs to raise short-term rates in the market without selling its own securities holdings. The Fed is who lends to Banks and by raising their interest rates charged to banks, they increase the costs of the banks when they lend to you. So you'll see. Interest Rate Decision Sep 18, PM ET. 2 Weeks; 4 Days; 21 Hours Trading on margin increases the financial risks. Before deciding to trade in. improve life for underserved communities. Learn more by reading our strategy Rate/Range EFFR Volume. Reference Rates Historical Data Search. Note. How are increases to the state minimum wage be determined after the minimum wage reached $15 an hour? After the state minimum wage reached $15 an hour, the rate.

Industry Growth

Our technology industry outlook examines recent challenges in the industry, a renewed focus on growth and innovation, and key considerations for tech. Premium wineries experienced mixed success during the past year. The value of premium wine is still growing, but we anticipate volume sales will finish lower. These are the industries that are projected to grow the fastest from to Select any industry to see a full report on the industry from the Bureau. The table below is based on the most recent nonfarm Current Employment Statistics (CES) data for 36 industries from the US Bureau of Labor Statistics (BLS). Industries with the fastest growing output ; Mining, quarrying, and oil and gas extraction · Healthcare and social assistance · Healthcare and social assistance. Explore our analysis of U.S. retail sales data for plant-based meat, dairy, eggs, and more, including category insights, size, growth, and purchase dynamics. Historical (Compounded Annual) Growth Rates by Sector ; Auto Parts, 39, % ; Bank (Money Center), 15, % ; Banks (Regional), , % ; Beverage (Alcoholic). All industries and related sub-industries · Advertising & Marketing · Agriculture · Chemicals & Resources · Construction · Consumer Goods & FMCG · E-Commerce · Economy. Growth is driven by demand for innovative products, whether consumer products or investment products, and the industries which cater to these demands. In. Our technology industry outlook examines recent challenges in the industry, a renewed focus on growth and innovation, and key considerations for tech. Premium wineries experienced mixed success during the past year. The value of premium wine is still growing, but we anticipate volume sales will finish lower. These are the industries that are projected to grow the fastest from to Select any industry to see a full report on the industry from the Bureau. The table below is based on the most recent nonfarm Current Employment Statistics (CES) data for 36 industries from the US Bureau of Labor Statistics (BLS). Industries with the fastest growing output ; Mining, quarrying, and oil and gas extraction · Healthcare and social assistance · Healthcare and social assistance. Explore our analysis of U.S. retail sales data for plant-based meat, dairy, eggs, and more, including category insights, size, growth, and purchase dynamics. Historical (Compounded Annual) Growth Rates by Sector ; Auto Parts, 39, % ; Bank (Money Center), 15, % ; Banks (Regional), , % ; Beverage (Alcoholic). All industries and related sub-industries · Advertising & Marketing · Agriculture · Chemicals & Resources · Construction · Consumer Goods & FMCG · E-Commerce · Economy. Growth is driven by demand for innovative products, whether consumer products or investment products, and the industries which cater to these demands. In.

A compound annual growth rate of % is expected (CAGR –). The enterprise density in the Manufacturing market is projected to amount to in Key Sectors Bring Focus to High Growth Industries. Focusing on the aerospace, agriculture/food manufacturing, clean technology, information and communication. The Industry Growth Forum (IGF) is the premier event for climate tech and cleantech entrepreneurs, investors, and experts from industry and the public sector. COVD has accelerated the growing understanding among consumers and the building industry GWI cautions that the growth in this sector should not be. BLS data for over industries, available in Alphabetical order by industry or NAICS (North American Industry Classification System) number order. Fastest Growing Industries in the US in · 1. Major Smart Appliance Manufacturing in the US · 2. Fruit & Nut Farming in the US · 3. Solar Power in the US. The aviation sector is growing fast and will continue to grow. The If this growth path is achieved by the air transport industry will then. Industry Reports; Full Increasing demand for composites in the automotive industry is anticipated to boost the market growth over the forecast period. Fastest Growing Industries Projections. Home | Fastest Growing Industries / Occupations | Employment by Educational Attainment | About the Data. Employment Projections estimate the changes in industry and occupational employment over time resulting from industry growth, technological change, and other. Expert industry market research to help you make better business Understand the growth trajectory of any industry with five-year data forecasts. Find support for innovative SMEs to overcome commercialisation and growth challenges. Industry Growth Centres are not-for-profit organisations, each led by a board of industry experts. webkeds.ru Defense Employers find that Michigan has one of the most talented, diverse and abundant workforces in the U.S. And with the growth. Sizing the CDFI Market: Understanding Industry Growth · Since , industry assets have tripled to over $ billion. · Many depository institutions, such as. Solar industry research data for the United States. Information and graphs about the growth of the solar energy industry. Frost & Sullivan empowers users to leverage disruptive technologies and innovations to drive transformational growth of their organizations. The primary reasons for the larger dollar sales increase were price increases and slightly stronger onsite sales growth versus distribution. These. Industry (including construction), value added (annual % growth) from The World Bank: Data. Why Kentucky for Onshoring and Post-COVID Growth. The UPS Worldport air cargo hub in Louisville, Ky., employs about 10, people and turns over cargo.

Agents Fees To Sell A House

An additional fee you may pay a real estate agent is for advertising and marketing. It could run up to 1% of your property's value. Is it really worth spending. Fixed commission is the traditional method when it comes to calculating commissions. It's based on the sale price multiplied by the negotiated commission rate. Traditional agents typically charge a total commission of 5–6% of your final selling price, translating into tens of thousands of dollars. The good news is you. Sell Your Home for as low as a 2% Commission* · SALE PRICE: $, · SAVE $20, · SAVE $7, Here's a breakdown of commission costs based on different home sale prices, using total commission rates of 5%, 3%, and %. We represent you and provide all the services you expect from a full-service agent, except we do not personally visit the property. Maximize Your Selling. Most real estate agents make money through commissions based on a percentage of a property's selling price. (Commissions can also be flat fees, but that is much. For California Realtors®, the average is 6 percent of the total sale price of the property. Most full-service agents calculate the cost as a percentage of the. On average, real estate commissions run 5% to 6% of a home's sale price, with the money typically split equally between the seller's and buyer's agents. On a. An additional fee you may pay a real estate agent is for advertising and marketing. It could run up to 1% of your property's value. Is it really worth spending. Fixed commission is the traditional method when it comes to calculating commissions. It's based on the sale price multiplied by the negotiated commission rate. Traditional agents typically charge a total commission of 5–6% of your final selling price, translating into tens of thousands of dollars. The good news is you. Sell Your Home for as low as a 2% Commission* · SALE PRICE: $, · SAVE $20, · SAVE $7, Here's a breakdown of commission costs based on different home sale prices, using total commission rates of 5%, 3%, and %. We represent you and provide all the services you expect from a full-service agent, except we do not personally visit the property. Maximize Your Selling. Most real estate agents make money through commissions based on a percentage of a property's selling price. (Commissions can also be flat fees, but that is much. For California Realtors®, the average is 6 percent of the total sale price of the property. Most full-service agents calculate the cost as a percentage of the. On average, real estate commissions run 5% to 6% of a home's sale price, with the money typically split equally between the seller's and buyer's agents. On a.

Estate agents are required by law to tell you what is included as part of their fee. You normally pay your fees upon completion (when the property sells and. When the house sells, that whole 6% commission, or $18,, will go towards paying commissions. If the listing brokerage and the buying brokerage decide on a Sell Your Home for as low as a 2% Commission* · SALE PRICE: $, · SAVE $20, · SAVE $7, What fees do I pay when selling my house with an estate agent? Estate agent fees generally range from % - % of the final property sale, depending on the. Always, should offer % to buyer's agents, that is rule of thumb from selling standpoint. Every investor who sells + houses a year. The real estate commission is often the largest cost to selling your home. In many cases, these commissions can total 5 percent to 6 percent of the sale cost. Yes, it's perfectly legal for an estate agent to charge a withdrawal fee but, again, they have to be upfront about it before you agree to use their services. Yes, hiring a listing agent to sell your home will typically cost between 3 to 5% of the sale price. In almost every residential real estate transaction, the BC. How Real Estate Agent Commissions Are Calculated. In U.S. real estate sales, it's normal for both the seller's agent to be paid a percentage of the final price. For example, an agent may charge an 8% commission for the first $, and 4% for the rest. To calculate this uneven rate, you can simply break it into two. In the US when you are the seller you have a listing agent and the buyer has a sellers agent (I know somewhat confusing) but typically the. This commission means that estate agents will charge $20,$25, to sell a one-million-dollar property. However, this is an average with a national range of. Estate agent fees typically range from %% depending on which estate agents you use, how many are selling your property – and how well you negotiate. For example, a seller who wishes to add an incentive to buyers' agents to show the property might pay his agent % of the sales price, but offer the buyer's. For example, a seller who wishes to add an incentive to buyers' agents to show the property might pay his agent % of the sales price, but offer the buyer's. The 6 to 7% fee covered both the Seller's agent and Buyer's agent. The average fee now per side of the contract, is about %. The standard commission for estate agents is 5% — % of the sale. However, there are no regulations governing the amount an estate agent should be paid. Yes, it's perfectly legal for an estate agent to charge a withdrawal fee but, again, they have to be upfront about it before you agree to use their services. There is no regulation on what agents can charge, however commissions fall somewhere between 5%-6% of the final sale price. What Is the Average Real Estate. Quick answer: The average total commission for real estate agents in Georgia is about % of the sale price. Considering Georgia's average home price and the.

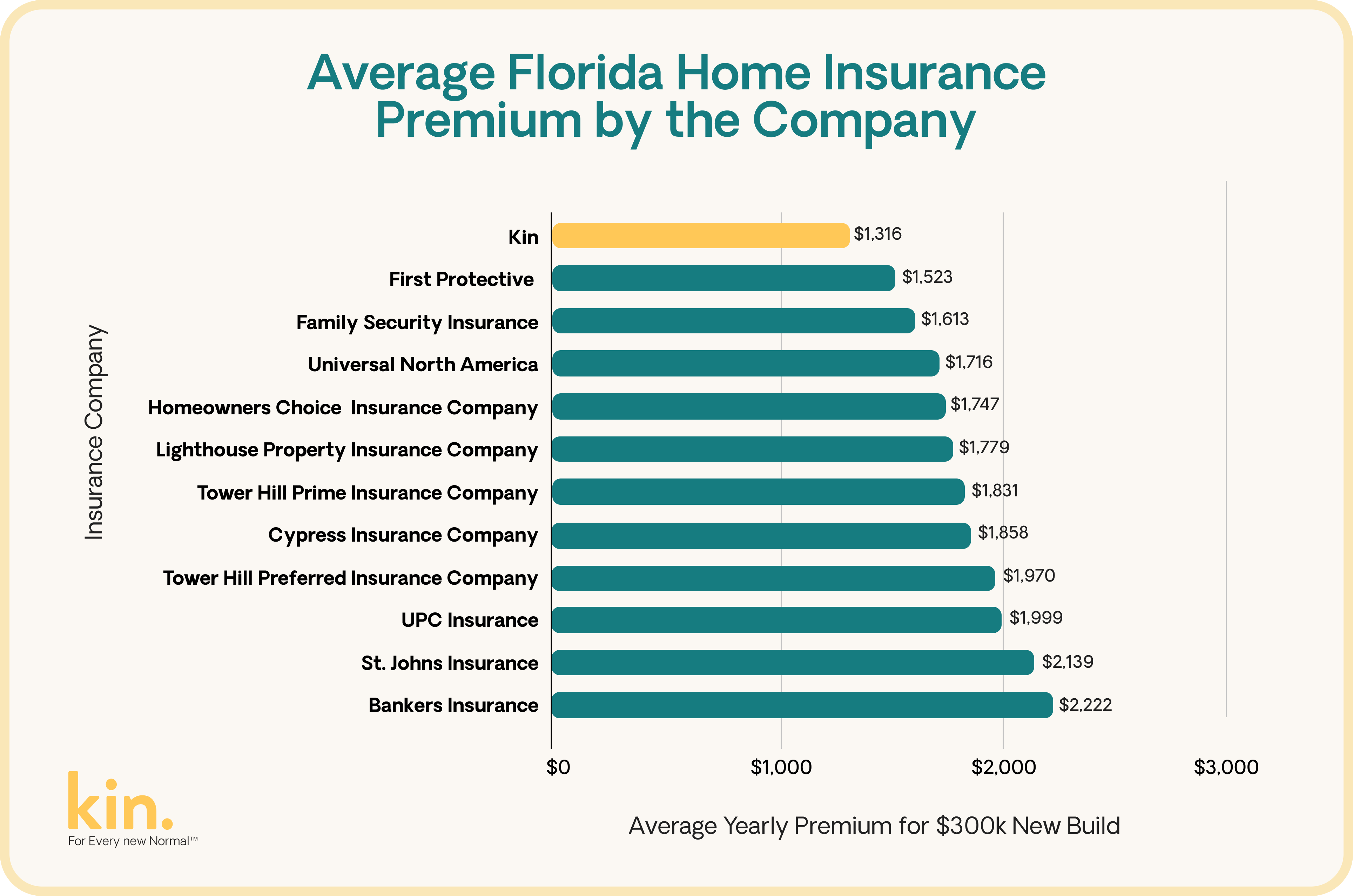

Average Homeowners Insurance Atlanta

The map and table below show the average cost of homeowners insurance by state and percentage of income spent, giving a quick view of how your state compares to. Who offers the best homeowners insurance rates in Georgia for a $K home? ; Georgia Farm Bureau Insurance, $ ; State Farm Insurance Company, $1, The average homeowners policy costs $ per month in Atlanta, Georgia. This is above the national average monthly cost of home insurance. The cost of home. Across the state, residents pay an average of $ a month for insurance. Monthly rates can vary from as low as $ to a high of $ The yearly cost for. How Much Does Home Insurance Cost in Georgia? On average, a home insurance policy in Georgia costs about $2,, which is above the national average of $2, Home insurance is expected to rise by at least $14 per month. And for states like Georgia, the increase is even sharper. $/year with USAA in Atlanta metro but we have max coverages. According to our research, the average cost of homeowners insurance for companies in our Georgia rating typically ranges between $2, and $3, per year. Average homeowners insurance cost in Atlanta, GA The average cost of homeowners insurance in Atlanta is $2, per year (for the coverage level of $, The map and table below show the average cost of homeowners insurance by state and percentage of income spent, giving a quick view of how your state compares to. Who offers the best homeowners insurance rates in Georgia for a $K home? ; Georgia Farm Bureau Insurance, $ ; State Farm Insurance Company, $1, The average homeowners policy costs $ per month in Atlanta, Georgia. This is above the national average monthly cost of home insurance. The cost of home. Across the state, residents pay an average of $ a month for insurance. Monthly rates can vary from as low as $ to a high of $ The yearly cost for. How Much Does Home Insurance Cost in Georgia? On average, a home insurance policy in Georgia costs about $2,, which is above the national average of $2, Home insurance is expected to rise by at least $14 per month. And for states like Georgia, the increase is even sharper. $/year with USAA in Atlanta metro but we have max coverages. According to our research, the average cost of homeowners insurance for companies in our Georgia rating typically ranges between $2, and $3, per year. Average homeowners insurance cost in Atlanta, GA The average cost of homeowners insurance in Atlanta is $2, per year (for the coverage level of $,

According to our research, the average cost of homeowners insurance for companies in our Georgia rating typically ranges between $2, and $3, per year. According to Bankrate, Georgians can expect to pay an average of $1, a year for their homeowners insurance (calculated for a hypothetical policy that comes. The average cost of homeowners insurance in Georgia is $1, per year or approximately $ per month for a policy with $, in dwelling coverage. This. The level of coverage you select has a significant impact on the cost of your home insurance. In Georgia, the average cost of carrying $K in dwelling. Homeowners insurance in Georgia costs an average of $2, per year. Compared with the national average, Georgia homeowners pay roughly 6% more for homeowners. Get a quote to see your Atlanta insurance rates today. Find an Agent Near You. One of our 19, agents is here to help. The average cost of homeowners insurance in Georgia is $ per month or $1, for an annual policy. Wind-related perils like tornadoes and hurricanes. The average monthly home insurance rate in Georgia for SelectQuote is $ Your home insurance premiums may differ based on several factors. These include. Get a free Georgia homeowners insurance quote today. Nationwide offers a variety of home insurance coverage options to protect your home and property. Average Cost of Home Insurance in Georgia by Credit Score. Homeowners in Georgia with poor credit ratings pay an average annual premium of $10, for. The average cost of homeowners insurance in Atlanta is about $2, annually, which is higher than the statewide average rate of $1, yearly. However, rates. Mercury Insurance provides the best homeowners insurance in Georgia at low rates. Get a home insurance quote and start saving today! The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). Homeowners Insurance Calculator. See How Your Home Insurance Rate Compares To The Market. Zip code. Your Annual Premium. Submit. Georgia homeowners pay $2, annually, on average, for a home insurance policy with a $1, deductible and $, in dwelling coverage, Insurify data. The average cost of homeowners insurance in Georgia is $1, a year. While this may seem rather high given the national average clocks in around $1, The average annual cost of U.S. homeowners insurance is $2, — or $ per month, according to data from Quadrant Information Services. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). We are one of Georgia's largest home insurers. We combine great coverage, competitive rates, and superior knowledge to make buying home insurance simple.

How Much Should I Spend On A New Car

:max_bytes(150000):strip_icc()/how-much-should-i-spend-on-a-car-5187853-Final-87443d24566b4badb1cbe262ed1643a8.jpg)

10 refers to spending no more than 10% of your net income on car payments including the principal, interest and insurance. For example, if your net annual. According to the formula, you should aim for a 20% down payment with a car loan of four years or less and spend no more than 10% of your monthly income on other. The common rule of thumb among financial experts is that you should spend less than 10% of your income on your car payment and not more than 15% to 20% of your. your personal circumstances; how much you want to spend on the car; if you're buying new or second-hand. In January , the average price of a new car was $49, and in December it was $48, Regardless of how much you spend on your car each year, less. The rule states that you should spend no more than 1/10th your gross annual income on the purchase price of a car. The car can be new or old. It doesn't matter. rule of thumb is about 20–30% of your monthly income including insurance,maintence, fuel. to be safe i would go half of that. it might not be the most luxurious. The total value of all your vehicles shouldn't be more than half your annual income. Why? Well, you don't want too much of your wealth tied up in things that. There's no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home. 10 refers to spending no more than 10% of your net income on car payments including the principal, interest and insurance. For example, if your net annual. According to the formula, you should aim for a 20% down payment with a car loan of four years or less and spend no more than 10% of your monthly income on other. The common rule of thumb among financial experts is that you should spend less than 10% of your income on your car payment and not more than 15% to 20% of your. your personal circumstances; how much you want to spend on the car; if you're buying new or second-hand. In January , the average price of a new car was $49, and in December it was $48, Regardless of how much you spend on your car each year, less. The rule states that you should spend no more than 1/10th your gross annual income on the purchase price of a car. The car can be new or old. It doesn't matter. rule of thumb is about 20–30% of your monthly income including insurance,maintence, fuel. to be safe i would go half of that. it might not be the most luxurious. The total value of all your vehicles shouldn't be more than half your annual income. Why? Well, you don't want too much of your wealth tied up in things that. There's no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home.

Running costs. Once you've purchased the vehicle, you need to keep it in good working order. Different types of vehicles carry different costs. For. One rule of thumb, popularised by financial guru Dave Ramsey, suggests that all your vehicles' combined value should be less than half of your annual take-home. How to Budget and Save for a New Car · Create a Timeline · Decide on the Type of Car You Want · Determine Your Down Payment Amount · Calculate Your Monthly Payment. How much should I pay for a car? · Don't spend more than 10% of your monthly take-home pay on your car finance payment. · The total cost of buying and running. One school of thought is that you spend about 10% of your income on transportation, including your car payment, insurance, and fuel. AAA has been tracking vehicle ownership costs for decades, and motorists are often surprised when they learn the full scope of the costs involved. In “It's smart to spend less than 10 percent of your monthly take-home pay on your car payment,” according to Reed. For example, if your monthly paycheck is $3, If you're wondering how much car you can afford, our car affordability calculator can help you figure out the most you can spend on a new car without. webkeds.ru Managing Editor Mike Sante says you shouldn't spend more than 10 percent of your pretax income on the combined cost of car payments and auto. Some personal finance gurus suggest that you can afford to spend much more than 10% of your gross income on a car, and banks will even loan you the money you. How much should you spend on a car based on your income? As a rule of thumb, you should never spend anything more than % of your income. Generally, it is. According to the formula, you should aim for a 20% down payment with a car loan of four years or less and spend no more than 10% of your monthly income on other. The latest Experian data shows that the average APR for a month new auto loan was %, a % increase from According to these figures, you could. How much should you spend on a car? Experts recommend spending no more than 10–15% of your income on a car payment, so set your price from there and see what. For instance, if your income is $3, per month and you already spend $ per month on credit card and loan payments, you can only afford a new monthly auto. For your first car, you can spend an average of $ to $ Most first-time car buyers can't afford a car worth more than $ When determining your car budget, there are some key rules to consider. One car-buying formula suggests not spending more than half of your annual income on a. According to this guideline, you should try to avoid spending any more than $10, a year (or $ per month) on your car payments. You'll also want to try to. Figure how much you can spend on a new automobile and stick to your budget. If you plan to finance your new car, compare rates from several lenders and make.

Td Ameritrade Free Paper Trading

TD Ameritrade, Inc. has been acquired by Charles Schwab, and all accounts have been moved. At Schwab, you get access to thinkorswim trading platforms and. TD Ameritrade's paper trading app allows you to practice with $, in virtual cash. On top of that, the paper trading account also gives you access to. Play our stock market simulator game. Make virtual simulated trades and learn how the US stock market works—all at no cost. Some brokerages with virtual accounts include Thinkorswim by TD Ameritrade, Webull and TradeStation. MarketWatch and Wealthbase offer free stock market. Automate your TradingView or TrendSpider strategies directly in TDAmeritrade. Send alerts to us and we'll send orders to your account! Start your free paper. Once you have opened an account with Charles Schwab, log in to thinkorswim Web to access essential trading tools and begin trading on our web-based. Thinkorswim is a highly acclaimed online trading software originally offered by TD Ameritrade. If you're an existing customer, you should already have access to. Interactive Brokers - Best for paper options trading. AvaTrade - The most secure trading platform. Thinkorswim by TD Ameritrade - Best for futures trading. Manage your positions; find quotes, charts, and studies; get support; and place trades easily and securely—all right from your phone or tablet. TD Ameritrade, Inc. has been acquired by Charles Schwab, and all accounts have been moved. At Schwab, you get access to thinkorswim trading platforms and. TD Ameritrade's paper trading app allows you to practice with $, in virtual cash. On top of that, the paper trading account also gives you access to. Play our stock market simulator game. Make virtual simulated trades and learn how the US stock market works—all at no cost. Some brokerages with virtual accounts include Thinkorswim by TD Ameritrade, Webull and TradeStation. MarketWatch and Wealthbase offer free stock market. Automate your TradingView or TrendSpider strategies directly in TDAmeritrade. Send alerts to us and we'll send orders to your account! Start your free paper. Once you have opened an account with Charles Schwab, log in to thinkorswim Web to access essential trading tools and begin trading on our web-based. Thinkorswim is a highly acclaimed online trading software originally offered by TD Ameritrade. If you're an existing customer, you should already have access to. Interactive Brokers - Best for paper options trading. AvaTrade - The most secure trading platform. Thinkorswim by TD Ameritrade - Best for futures trading. Manage your positions; find quotes, charts, and studies; get support; and place trades easily and securely—all right from your phone or tablet.

paper trading app based on the popular brokerage firm's trading platform. free access to any prep course of their choice*. We also hold a national. Trading papers provide a practical learning experience where you are free The TD Ameritrade PaperMoney provides a realistic trading experience. You must fund a TD account to access their ThinkorSwim paper money trading platform. Besides, TD now offers free commission trading! You want fast executions. TD Ameritrade's paper trading app allows you to practice with $, in virtual cash. free trading for stocks, ETFs, and options. On top of the low. Most people put minimum money to open a brokerage (e.g. dollars) to use it. The best is ThinkorSwim affiliated with TD Ameritrade. Top Picks for Paper Trading Accounts. ThinkorSwim by TD Ameritrade; Trader Workstation (TWS) by Interactive Brokers · TradeStation Free? Charles Schwab. 1. Thinkorswim by TD Ameritrade · Real-time data and fast execution: Essential for scalpers. · Advanced charting tools: Customizable and detailed. Verdict: For clients in the United States, the TD Ameritrade paper trading platform is packed with alluring features. You may paper trade for free using demo. paper trading app based on the popular brokerage firm's trading platform. free access to any prep course of their choice*. We also hold a national. TD Ameritrade to start a mutually beneficial business partnership. Table of Contents. Why do you need a Paper Money account? A free Paper Money account is an. how to use the practice trading account inside of TD Ameritrade thinkorswim practice trading paper trading free 1-hour options trading training by clicking. I have a free TD Ameritrade paper trading account called paperMoney, which was originally developed by Think or Swim. I was trying to let NT connect to this. Trading at Schwab is now powered by Ameritrade. Award-winning thinkorswim Commission-free trading experience. Trade listed equities online for $0. TD Ameritrade's thinkorswim, now at Charles Schwab, offer clients paper trading simulators. Investopedia provides a free simulator for trading stocks. Get a Free PaperMoney Demo Account. Thinkorswim is a premiere, feature-rich thinkorswim Software can be run using either “real” or “paper” (fake) money. Put the power of thinkorswim® right in your pocket with our trading app. Manage your positions; find quotes, charts, and studies; get support;. Trading papers provide a practical learning experience where you are free The TD Ameritrade PaperMoney provides a realistic trading experience. trading platforms offering advanced analysis tools and demo accounts for paper trading. Thinkorswim by TD Ameritrade: A robust trading platform with extensive. Paper Trading Environment: TD Ameritrade's paper trading feature allows users to practice trading strategies and test algorithms in a simulated environment. Originally developed by Thinkorswim Group Inc., it was later acquired by TD Ameritrade, and most recently by Charles Schwab in Explore risk-free trading.

Easter Monday A Holiday

No, Easter isn't a national holiday in the United States. Easter in the U.S.. Easter, which falls on the first Sunday following the first full moon after. Our National Public Holidays are New Year's Day, Australia Day, Good Friday, Easter Monday, Anzac Day, Christmas Day and Boxing Day. In the Nordic countries, Good Friday, Easter Sunday, and Easter Monday are public holidays, and Good Friday and Easter Monday are bank holidays. *For holidays falling on Saturday, Federal Reserve banks and branches will be open the preceding Friday; however, the Board of Governors will be closed. **For. holidays. Monday. January 1. New Year's Day. Monday. January Martin Christmas Madonna and Child and Holiday Joy Stamp Dedication Ceremonies and. April 6, , Easter Monday , Monday, 15, ; March 29, , Easter Monday , Monday, 13, No. Religious holidays aren't public holidays. The only exception is Christmas. If a holiday falls on a Saturday, for most Federal employees, the preceding Friday will be treated as a holiday for pay and leave purposes. Easter Monday takes place on the day after Easter. It is not a federal holiday in the United States, or widely observed. But, it is informally observ. No, Easter isn't a national holiday in the United States. Easter in the U.S.. Easter, which falls on the first Sunday following the first full moon after. Our National Public Holidays are New Year's Day, Australia Day, Good Friday, Easter Monday, Anzac Day, Christmas Day and Boxing Day. In the Nordic countries, Good Friday, Easter Sunday, and Easter Monday are public holidays, and Good Friday and Easter Monday are bank holidays. *For holidays falling on Saturday, Federal Reserve banks and branches will be open the preceding Friday; however, the Board of Governors will be closed. **For. holidays. Monday. January 1. New Year's Day. Monday. January Martin Christmas Madonna and Child and Holiday Joy Stamp Dedication Ceremonies and. April 6, , Easter Monday , Monday, 15, ; March 29, , Easter Monday , Monday, 13, No. Religious holidays aren't public holidays. The only exception is Christmas. If a holiday falls on a Saturday, for most Federal employees, the preceding Friday will be treated as a holiday for pay and leave purposes. Easter Monday takes place on the day after Easter. It is not a federal holiday in the United States, or widely observed. But, it is informally observ.

Easter holidays: two weeks either side of Easter Sunday; Summer half-term: one week at end of May or early June. However, many local authorities have adopted a. Standard Federal Reserve Bank Holidays *For holidays falling on Saturday, Federal Reserve Banks and Branches will be open the preceding Friday. **For holidays. NSW Public Holidays ; Easter Sunday. Sunday, 31 March. Sunday, 20 April ; Easter Monday. Monday, 1 April. Monday, 21 April ; Anzac Day. Thursday, 25 April. Friday. Only Good Friday and Easter Monday are public holidays. Easter Sunday is not a public holiday, and shops can choose to open if their local council lets them. Easter Monday is a Christian holiday celebrated the day after Easter Sunday. In many countries in Europe and South America, this day is known as "Little. Holidays falling on Sunday are observed on Monday. Saturday holidays are observed on Saturday. Federal offices are only closed on federally-recognized holidays. Date, Holiday. Monday, January 1st, New Year's Day. Monday, January 15th, Martin Luther King, Jr. Day. Monday, February 19th, Presidents' Day. Is Good Friday a Federal Holiday? No, Good Friday and Easter Monday are not Federal Holidays. All federal holidays are non-religious (other than Christmas Day). Public holidays · Nieuwjaarsdag (New Year's Day): Monday 1 January · Goede vrijdag (Good Friday): Friday 29 March · Eerste en tweede paasdag (Easter. January. 1 - New Years Day · February. 3rd Monday - Presidents' Day · March. 2 - Texas Independence Day (partial staffing holiday) · April. Good Friday (Optional. Easter Monday Holiday The Monday after Easter, rather than Good Friday as in every other state, was a legal holiday in North Carolina for 52 years. The bill. Easter Monday is simply the day after Easter. Easter Monday is a public holiday in Australia, Egypt (as a secular holiday), and much of Europe. Please note that most Federal employees work on a Monday through Friday schedule. For these employees, when a holiday falls on a nonworkday -- Saturday or. Only Good Friday and Easter Monday are public holidays. Easter Sunday is not a public holiday, and shops can choose to open if their local council lets them. Easter consists almost only of Good Friday, and Whitsun seems to be dispensed with entirely. Even Christmas, which is a holiday with several days off elsewhere. Upcoming bank holidays in England and Wales ; Wednesday · Friday · Monday · Monday ; New Year's Day · Good Friday · Easter Monday · Early May bank holiday. Holidays Designated by the Governor · Good Friday - The Friday before Easter Sunday · Thanksgiving Day - The Fourth Thursday in November. From 1 January Easter Sunday is a public holiday, therefore all four days of Easter are now public holidays. Bank holidays. All public holidays and Sundays. Easter Sunday is not a federal holiday. States also designate holidays, meaning holidays on which non-essential state government offices close. Easter Monday, Monday after Easter Sunday, QC ; St. George's Day, April 23, NL ; Victoria Day National Patriotes Day in QC, Monday preceding May 25th, Nationwide.

Apps That Will Let Me Borrow Money

These include DailyPay and PayActiv. You'll only have access to these if you work for a participating employer. Which app lets me borrow money instantly? We're Bankrate's #1 app for saving money in ✨ Learn more · Oportun · Loans Let's say you need a larger loan. You can use your car title to secure. Get an Instant Cash advance, build credit, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health & budgeting. Dave offers free cash advances worth up to $, but there's a $1 monthly membership fee. If approved, you'll typically receive the funds within three business. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. It's money you can borrow on an ongoing basis, so long as you remain eligible. Lines of credit allow you to use money, repay it, and then use it again without. Other popular apps include PaySense, MoneyTap, and CASHe, which provide instant loans tailored to various financial needs. These apps ensure a. Prestamos USA simplifies the loan process, offering quick decisions within minutes of application. With a user-friendly platform, applicants can. MoneyLion: Best For Deferred Payment Option MoneyLion offers cash advances up to $ with no interest or monthly subscription fee. If you have a paid Credit. These include DailyPay and PayActiv. You'll only have access to these if you work for a participating employer. Which app lets me borrow money instantly? We're Bankrate's #1 app for saving money in ✨ Learn more · Oportun · Loans Let's say you need a larger loan. You can use your car title to secure. Get an Instant Cash advance, build credit, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health & budgeting. Dave offers free cash advances worth up to $, but there's a $1 monthly membership fee. If approved, you'll typically receive the funds within three business. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. It's money you can borrow on an ongoing basis, so long as you remain eligible. Lines of credit allow you to use money, repay it, and then use it again without. Other popular apps include PaySense, MoneyTap, and CASHe, which provide instant loans tailored to various financial needs. These apps ensure a. Prestamos USA simplifies the loan process, offering quick decisions within minutes of application. With a user-friendly platform, applicants can. MoneyLion: Best For Deferred Payment Option MoneyLion offers cash advances up to $ with no interest or monthly subscription fee. If you have a paid Credit.

The Possible mobile application can create your account and process your loan request within a matter of minutes. Qualified applicants can immediately borrow up. Another online banking app that offers a combination of early cash advances and early paycheck access is MoneyLion. Its Instacash feature lets you borrow up to. The Mooch app lets you lend, borrow, and track your stuff with a private group of friends to save money, reduce waste, and have more community. 12 Apps That Let You Borrow Money Instantly [Official Guide]. Access up to $ on your own terms or supply funds to make a social impact and return. Fun fact → SoLo Funds is a Certified Public Benefit Corporation. EarnIn is a paycheck advance app that allows you to borrow up to $ per day or $ per pay period with no interest or fees. Paycheck advance apps allow you. Cash Advance Rates and Fees. Select the amount you would like to borrow. $ Complete a short application, sign an agreement, and write a check for. EarnIn: Best for large cash advances. The EarnIn app tracks your location or work hours to determine how much you can borrow. If you need more than other apps. Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. Cash advance apps – also called payday advance apps – allow you to borrow money in advance of your paycheck. will borrow money. Can I Get a Payday. What's the Most That a Cash App Will Let You Borrow? The unneeded stress from being short on bills can be overwhelming, and the late fees and overdraft charges can quickly stack up. Let Gerald help you get your. Why we chose Possible: Possible Finance offers almost identical loan products as SoLo Funds. The Possible Loan can help borrowers avoid paying the astronomical. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. 12 Apps That Let You Borrow Money Instantly [Official Guide]. Vola Finance - A Membership That Pays! Get instant access to advances up to $ today. Avoid overdraft fees, manage your money smartly, and build your. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. Like Moneylion, Brigit is a well-known app that lets users borrow money while building their credit. It offers users simple financial solutions like immediate. Cleo is more inclusive than other cash advance apps. We just ask for a few details like your name and address so that we know you're human.